Public Member Functions | |

| FundShareClassAllOf (string shortCode=default(string), string fundShareClassType=default(string), string distributionPaymentType=default(string), string hedging=default(string), string domCcy=default(string), InstrumentTypeEnum instrumentType=default(InstrumentTypeEnum)) | |

| Initializes a new instance of the FundShareClassAllOf class. More... | |

| override string | ToString () |

| Returns the string presentation of the object More... | |

| virtual string | ToJson () |

| Returns the JSON string presentation of the object More... | |

| override bool | Equals (object input) |

| Returns true if objects are equal More... | |

| bool | Equals (FundShareClassAllOf input) |

| Returns true if FundShareClassAllOf instances are equal More... | |

| override int | GetHashCode () |

| Gets the hash code More... | |

Protected Member Functions | |

| FundShareClassAllOf () | |

| Initializes a new instance of the FundShareClassAllOf class. More... | |

Properties | |

| InstrumentTypeEnum | InstrumentType [get, set] |

| The available values are: QuotedSecurity, InterestRateSwap, FxForward, Future, ExoticInstrument, FxOption, CreditDefaultSwap, InterestRateSwaption, Bond, EquityOption, FixedLeg, FloatingLeg, BespokeCashFlowsLeg, Unknown, TermDeposit, ContractForDifference, EquitySwap, CashPerpetual, CapFloor, CashSettled, CdsIndex, Basket, FundingLeg, FxSwap, ForwardRateAgreement, SimpleInstrument, Repo, Equity, ExchangeTradedOption, ReferenceInstrument, ComplexBond, InflationLinkedBond, InflationSwap, SimpleCashFlowLoan, TotalReturnSwap, InflationLeg, FundShareClass, FlexibleLoan More... | |

| string | ShortCode [get, set] |

| A short identifier, unique across a single fund, usually made up of the ShareClass components. Eg "A Accumulation Euro Hedged Class" could become "A Acc H EUR". More... | |

| string | FundShareClassType [get, set] |

| The type of distribution that the ShareClass will calculate. Can be either 'Income' or 'Accumulation' - Income classes will pay out and Accumulation classes will retain their ShareClass attributable income. Supported string (enumeration) values are: [Income, Accumulation]. More... | |

| string | DistributionPaymentType [get, set] |

| The tax treatment applied to any distributions calculated within the ShareClass. Can be either 'Net' (Distribution Calculated net of tax) or 'Gross' (Distribution calculated gross of tax). Supported string (enumeration) values are: [Gross, Net]. More... | |

| string | Hedging [get, set] |

| A flag to indicate the ShareClass is operating currency hedging as a means to limit currency risk as part of it's investment strategy. Supported string (enumeration) values are: [Invalid, None, ApplyHedging]. More... | |

| string | DomCcy [get, set] |

| The domestic currency of the instrument. More... | |

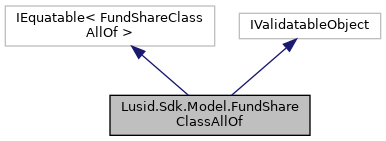

Detailed Description

Member Enumeration Documentation

◆ InstrumentTypeEnum

The available values are: QuotedSecurity, InterestRateSwap, FxForward, Future, ExoticInstrument, FxOption, CreditDefaultSwap, InterestRateSwaption, Bond, EquityOption, FixedLeg, FloatingLeg, BespokeCashFlowsLeg, Unknown, TermDeposit, ContractForDifference, EquitySwap, CashPerpetual, CapFloor, CashSettled, CdsIndex, Basket, FundingLeg, FxSwap, ForwardRateAgreement, SimpleInstrument, Repo, Equity, ExchangeTradedOption, ReferenceInstrument, ComplexBond, InflationLinkedBond, InflationSwap, SimpleCashFlowLoan, TotalReturnSwap, InflationLeg, FundShareClass, FlexibleLoan

The available values are: QuotedSecurity, InterestRateSwap, FxForward, Future, ExoticInstrument, FxOption, CreditDefaultSwap, InterestRateSwaption, Bond, EquityOption, FixedLeg, FloatingLeg, BespokeCashFlowsLeg, Unknown, TermDeposit, ContractForDifference, EquitySwap, CashPerpetual, CapFloor, CashSettled, CdsIndex, Basket, FundingLeg, FxSwap, ForwardRateAgreement, SimpleInstrument, Repo, Equity, ExchangeTradedOption, ReferenceInstrument, ComplexBond, InflationLinkedBond, InflationSwap, SimpleCashFlowLoan, TotalReturnSwap, InflationLeg, FundShareClass, FlexibleLoan

| Enumerator | |

|---|---|

| QuotedSecurity | Enum QuotedSecurity for value: QuotedSecurity |

| InterestRateSwap | Enum InterestRateSwap for value: InterestRateSwap |

| FxForward | |

| Future | |

| ExoticInstrument | Enum ExoticInstrument for value: ExoticInstrument |

| FxOption | |

| CreditDefaultSwap | Enum CreditDefaultSwap for value: CreditDefaultSwap |

| InterestRateSwaption | Enum InterestRateSwaption for value: InterestRateSwaption |

| Bond | |

| EquityOption | Enum EquityOption for value: EquityOption |

| FixedLeg | |

| FloatingLeg | Enum FloatingLeg for value: FloatingLeg |

| BespokeCashFlowsLeg | Enum BespokeCashFlowsLeg for value: BespokeCashFlowsLeg |

| Unknown | Enum Unknown for value: Unknown |

| TermDeposit | Enum TermDeposit for value: TermDeposit |

| ContractForDifference | Enum ContractForDifference for value: ContractForDifference |

| EquitySwap | Enum EquitySwap for value: EquitySwap |

| CashPerpetual | Enum CashPerpetual for value: CashPerpetual |

| CapFloor | |

| CashSettled | Enum CashSettled for value: CashSettled |

| CdsIndex | |

| Basket | |

| FundingLeg | Enum FundingLeg for value: FundingLeg |

| FxSwap | |

| ForwardRateAgreement | Enum ForwardRateAgreement for value: ForwardRateAgreement |

| SimpleInstrument | Enum SimpleInstrument for value: SimpleInstrument |

| Repo | |

| Equity | |

| ExchangeTradedOption | Enum ExchangeTradedOption for value: ExchangeTradedOption |

| ReferenceInstrument | Enum ReferenceInstrument for value: ReferenceInstrument |

| ComplexBond | Enum ComplexBond for value: ComplexBond |

| InflationLinkedBond | Enum InflationLinkedBond for value: InflationLinkedBond |

| InflationSwap | Enum InflationSwap for value: InflationSwap |

| SimpleCashFlowLoan | Enum SimpleCashFlowLoan for value: SimpleCashFlowLoan |

| TotalReturnSwap | Enum TotalReturnSwap for value: TotalReturnSwap |

| InflationLeg | Enum InflationLeg for value: InflationLeg |

| FundShareClass | Enum FundShareClass for value: FundShareClass |

| FlexibleLoan | Enum FlexibleLoan for value: FlexibleLoan |

Constructor & Destructor Documentation

◆ FundShareClassAllOf() [1/2]

|

inlineprotected |

Initializes a new instance of the FundShareClassAllOf class.

◆ FundShareClassAllOf() [2/2]

|

inline |

Initializes a new instance of the FundShareClassAllOf class.

- Parameters

-

shortCode A short identifier, unique across a single fund, usually made up of the ShareClass components. Eg "A Accumulation Euro Hedged Class" could become "A Acc H EUR". (required). fundShareClassType The type of distribution that the ShareClass will calculate. Can be either 'Income' or 'Accumulation' - Income classes will pay out and Accumulation classes will retain their ShareClass attributable income. Supported string (enumeration) values are: [Income, Accumulation]. (required). distributionPaymentType The tax treatment applied to any distributions calculated within the ShareClass. Can be either 'Net' (Distribution Calculated net of tax) or 'Gross' (Distribution calculated gross of tax). Supported string (enumeration) values are: [Gross, Net]. (required). hedging A flag to indicate the ShareClass is operating currency hedging as a means to limit currency risk as part of it's investment strategy. Supported string (enumeration) values are: [Invalid, None, ApplyHedging]. (required). domCcy The domestic currency of the instrument. (required). instrumentType The available values are: QuotedSecurity, InterestRateSwap, FxForward, Future, ExoticInstrument, FxOption, CreditDefaultSwap, InterestRateSwaption, Bond, EquityOption, FixedLeg, FloatingLeg, BespokeCashFlowsLeg, Unknown, TermDeposit, ContractForDifference, EquitySwap, CashPerpetual, CapFloor, CashSettled, CdsIndex, Basket, FundingLeg, FxSwap, ForwardRateAgreement, SimpleInstrument, Repo, Equity, ExchangeTradedOption, ReferenceInstrument, ComplexBond, InflationLinkedBond, InflationSwap, SimpleCashFlowLoan, TotalReturnSwap, InflationLeg, FundShareClass, FlexibleLoan (required).

Member Function Documentation

◆ Equals() [1/2]

|

inline |

Returns true if FundShareClassAllOf instances are equal

- Parameters

-

input Instance of FundShareClassAllOf to be compared

- Returns

- Boolean

◆ Equals() [2/2]

|

inline |

Returns true if objects are equal

- Parameters

-

input Object to be compared

- Returns

- Boolean

◆ GetHashCode()

|

inline |

Gets the hash code

- Returns

- Hash code

◆ ToJson()

|

inlinevirtual |

Returns the JSON string presentation of the object

- Returns

- JSON string presentation of the object

◆ ToString()

|

inline |

Returns the string presentation of the object

- Returns

- String presentation of the object

Property Documentation

◆ DistributionPaymentType

|

getset |

The tax treatment applied to any distributions calculated within the ShareClass. Can be either 'Net' (Distribution Calculated net of tax) or 'Gross' (Distribution calculated gross of tax). Supported string (enumeration) values are: [Gross, Net].

The tax treatment applied to any distributions calculated within the ShareClass. Can be either 'Net' (Distribution Calculated net of tax) or 'Gross' (Distribution calculated gross of tax). Supported string (enumeration) values are: [Gross, Net].

◆ DomCcy

|

getset |

The domestic currency of the instrument.

The domestic currency of the instrument.

◆ FundShareClassType

|

getset |

The type of distribution that the ShareClass will calculate. Can be either 'Income' or 'Accumulation' - Income classes will pay out and Accumulation classes will retain their ShareClass attributable income. Supported string (enumeration) values are: [Income, Accumulation].

The type of distribution that the ShareClass will calculate. Can be either 'Income' or 'Accumulation' - Income classes will pay out and Accumulation classes will retain their ShareClass attributable income. Supported string (enumeration) values are: [Income, Accumulation].

◆ Hedging

|

getset |

A flag to indicate the ShareClass is operating currency hedging as a means to limit currency risk as part of it's investment strategy. Supported string (enumeration) values are: [Invalid, None, ApplyHedging].

A flag to indicate the ShareClass is operating currency hedging as a means to limit currency risk as part of it's investment strategy. Supported string (enumeration) values are: [Invalid, None, ApplyHedging].

◆ InstrumentType

|

getset |

The available values are: QuotedSecurity, InterestRateSwap, FxForward, Future, ExoticInstrument, FxOption, CreditDefaultSwap, InterestRateSwaption, Bond, EquityOption, FixedLeg, FloatingLeg, BespokeCashFlowsLeg, Unknown, TermDeposit, ContractForDifference, EquitySwap, CashPerpetual, CapFloor, CashSettled, CdsIndex, Basket, FundingLeg, FxSwap, ForwardRateAgreement, SimpleInstrument, Repo, Equity, ExchangeTradedOption, ReferenceInstrument, ComplexBond, InflationLinkedBond, InflationSwap, SimpleCashFlowLoan, TotalReturnSwap, InflationLeg, FundShareClass, FlexibleLoan

The available values are: QuotedSecurity, InterestRateSwap, FxForward, Future, ExoticInstrument, FxOption, CreditDefaultSwap, InterestRateSwaption, Bond, EquityOption, FixedLeg, FloatingLeg, BespokeCashFlowsLeg, Unknown, TermDeposit, ContractForDifference, EquitySwap, CashPerpetual, CapFloor, CashSettled, CdsIndex, Basket, FundingLeg, FxSwap, ForwardRateAgreement, SimpleInstrument, Repo, Equity, ExchangeTradedOption, ReferenceInstrument, ComplexBond, InflationLinkedBond, InflationSwap, SimpleCashFlowLoan, TotalReturnSwap, InflationLeg, FundShareClass, FlexibleLoan

◆ ShortCode

|

getset |

A short identifier, unique across a single fund, usually made up of the ShareClass components. Eg "A Accumulation Euro Hedged Class" could become "A Acc H EUR".

A short identifier, unique across a single fund, usually made up of the ShareClass components. Eg "A Accumulation Euro Hedged Class" could become "A Acc H EUR".

The documentation for this class was generated from the following file:

- /home/docs/checkouts/readthedocs.org/user_builds/lusid-sdk-csharp/checkouts/latest/sdk/Lusid.Sdk/Model/FundShareClassAllOf.cs