LUSID representation of an Inflation Swap. The implementation supports the following swap types: * Zero Coupon inflation swap, with a single payment at maturity. * LPI Swap (capped and floored) * Year on Year inflation swap This instrument has multiple legs, to see how legs are used in LUSID see knowledge base article KA-02252. | Leg Index | Leg Identifier | Description | | - – – – – | - – – – – – – - | - – – – – – | | 1 | InflationLeg | Cash flows with a rate relating to an underlying inflation index. | | 2 | FixedLeg | Cash flows with a fixed rate. |

More...

|

| DateTimeOffset | StartDate [get, set] |

| | The start date of the instrument. This is normally synonymous with the trade-date. More...

|

| |

| DateTimeOffset | MaturityDate [get, set] |

| | The final maturity date of the instrument. This means the last date on which the instruments makes a payment of any amount. For the avoidance of doubt, that is not necessarily prior to its last sensitivity date for the purposes of risk; e.g. instruments such as Constant Maturity Swaps (CMS) often have sensitivities to rates that may well be observed or set prior to the maturity date, but refer to a termination date beyond it. More...

|

| |

| InflationLeg | InflationLeg [get, set] |

| | Gets or Sets InflationLeg More...

|

| |

| FixedLeg | FixedLeg [get, set] |

| | Gets or Sets FixedLeg More...

|

| |

| InstrumentTypeEnum | InstrumentType [get, set] |

| | The available values are: QuotedSecurity, InterestRateSwap, FxForward, Future, ExoticInstrument, FxOption, CreditDefaultSwap, InterestRateSwaption, Bond, EquityOption, FixedLeg, FloatingLeg, BespokeCashFlowsLeg, Unknown, TermDeposit, ContractForDifference, EquitySwap, CashPerpetual, CapFloor, CashSettled, CdsIndex, Basket, FundingLeg, FxSwap, ForwardRateAgreement, SimpleInstrument, Repo, Equity, ExchangeTradedOption, ReferenceInstrument, ComplexBond, InflationLinkedBond, InflationSwap, SimpleCashFlowLoan, TotalReturnSwap, InflationLeg, FundShareClass, FlexibleLoan More...

|

| |

|

| enum class | InstrumentTypeEnum {

QuotedSecurity = 1

, InterestRateSwap = 2

, FxForward = 3

, Future = 4

,

ExoticInstrument = 5

, FxOption = 6

, CreditDefaultSwap = 7

, InterestRateSwaption = 8

,

Bond = 9

, EquityOption = 10

, FixedLeg = 11

, FloatingLeg = 12

,

BespokeCashFlowsLeg = 13

, Unknown = 14

, TermDeposit = 15

, ContractForDifference = 16

,

EquitySwap = 17

, CashPerpetual = 18

, CapFloor = 19

, CashSettled = 20

,

CdsIndex = 21

, Basket = 22

, FundingLeg = 23

, FxSwap = 24

,

ForwardRateAgreement = 25

, SimpleInstrument = 26

, Repo = 27

, Equity = 28

,

ExchangeTradedOption = 29

, ReferenceInstrument = 30

, ComplexBond = 31

, InflationLinkedBond = 32

,

InflationSwap = 33

, SimpleCashFlowLoan = 34

, TotalReturnSwap = 35

, InflationLeg = 36

,

FundShareClass = 37

, FlexibleLoan = 38

} |

| | The available values are: QuotedSecurity, InterestRateSwap, FxForward, Future, ExoticInstrument, FxOption, CreditDefaultSwap, InterestRateSwaption, Bond, EquityOption, FixedLeg, FloatingLeg, BespokeCashFlowsLeg, Unknown, TermDeposit, ContractForDifference, EquitySwap, CashPerpetual, CapFloor, CashSettled, CdsIndex, Basket, FundingLeg, FxSwap, ForwardRateAgreement, SimpleInstrument, Repo, Equity, ExchangeTradedOption, ReferenceInstrument, ComplexBond, InflationLinkedBond, InflationSwap, SimpleCashFlowLoan, TotalReturnSwap, InflationLeg, FundShareClass, FlexibleLoan More...

|

| |

LUSID representation of an Inflation Swap. The implementation supports the following swap types: * Zero Coupon inflation swap, with a single payment at maturity. * LPI Swap (capped and floored) * Year on Year inflation swap This instrument has multiple legs, to see how legs are used in LUSID see knowledge base article KA-02252. | Leg Index | Leg Identifier | Description | | - – – – – | - – – – – – – - | - – – – – – | | 1 | InflationLeg | Cash flows with a rate relating to an underlying inflation index. | | 2 | FixedLeg | Cash flows with a fixed rate. |

| DateTimeOffset Lusid.Sdk.Model.InflationSwap.MaturityDate |

|

getset |

The final maturity date of the instrument. This means the last date on which the instruments makes a payment of any amount. For the avoidance of doubt, that is not necessarily prior to its last sensitivity date for the purposes of risk; e.g. instruments such as Constant Maturity Swaps (CMS) often have sensitivities to rates that may well be observed or set prior to the maturity date, but refer to a termination date beyond it.

The final maturity date of the instrument. This means the last date on which the instruments makes a payment of any amount. For the avoidance of doubt, that is not necessarily prior to its last sensitivity date for the purposes of risk; e.g. instruments such as Constant Maturity Swaps (CMS) often have sensitivities to rates that may well be observed or set prior to the maturity date, but refer to a termination date beyond it.

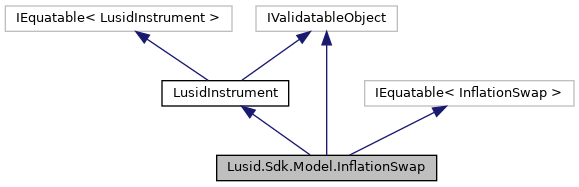

Public Member Functions inherited from Lusid.Sdk.Model.LusidInstrument

Public Member Functions inherited from Lusid.Sdk.Model.LusidInstrument Protected Member Functions inherited from Lusid.Sdk.Model.LusidInstrument

Protected Member Functions inherited from Lusid.Sdk.Model.LusidInstrument Properties inherited from Lusid.Sdk.Model.LusidInstrument

Properties inherited from Lusid.Sdk.Model.LusidInstrument