|

| string | ShortCode [get, set] |

| | A short identifier, unique across a single fund, usually made up of the ShareClass components. Eg "A Accumulation Euro Hedged Class" could become "A Acc H EUR". More...

|

| |

| string | FundShareClassType [get, set] |

| | The type of distribution that the ShareClass will calculate. Can be either 'Income' or 'Accumulation' - Income classes will pay out and Accumulation classes will retain their ShareClass attributable income. Supported string (enumeration) values are: [Income, Accumulation]. More...

|

| |

| string | DistributionPaymentType [get, set] |

| | The tax treatment applied to any distributions calculated within the ShareClass. Can be either 'Net' (Distribution Calculated net of tax) or 'Gross' (Distribution calculated gross of tax). Supported string (enumeration) values are: [Gross, Net]. More...

|

| |

| string | Hedging [get, set] |

| | A flag to indicate the ShareClass is operating currency hedging as a means to limit currency risk as part of it's investment strategy. Supported string (enumeration) values are: [Invalid, None, ApplyHedging]. More...

|

| |

| string | DomCcy [get, set] |

| | The domestic currency of the instrument. More...

|

| |

| InstrumentTypeEnum | InstrumentType [get, set] |

| | The available values are: QuotedSecurity, InterestRateSwap, FxForward, Future, ExoticInstrument, FxOption, CreditDefaultSwap, InterestRateSwaption, Bond, EquityOption, FixedLeg, FloatingLeg, BespokeCashFlowsLeg, Unknown, TermDeposit, ContractForDifference, EquitySwap, CashPerpetual, CapFloor, CashSettled, CdsIndex, Basket, FundingLeg, FxSwap, ForwardRateAgreement, SimpleInstrument, Repo, Equity, ExchangeTradedOption, ReferenceInstrument, ComplexBond, InflationLinkedBond, InflationSwap, SimpleCashFlowLoan, TotalReturnSwap, InflationLeg, FundShareClass, FlexibleLoan More...

|

| |

|

| enum class | InstrumentTypeEnum {

QuotedSecurity = 1

, InterestRateSwap = 2

, FxForward = 3

, Future = 4

,

ExoticInstrument = 5

, FxOption = 6

, CreditDefaultSwap = 7

, InterestRateSwaption = 8

,

Bond = 9

, EquityOption = 10

, FixedLeg = 11

, FloatingLeg = 12

,

BespokeCashFlowsLeg = 13

, Unknown = 14

, TermDeposit = 15

, ContractForDifference = 16

,

EquitySwap = 17

, CashPerpetual = 18

, CapFloor = 19

, CashSettled = 20

,

CdsIndex = 21

, Basket = 22

, FundingLeg = 23

, FxSwap = 24

,

ForwardRateAgreement = 25

, SimpleInstrument = 26

, Repo = 27

, Equity = 28

,

ExchangeTradedOption = 29

, ReferenceInstrument = 30

, ComplexBond = 31

, InflationLinkedBond = 32

,

InflationSwap = 33

, SimpleCashFlowLoan = 34

, TotalReturnSwap = 35

, InflationLeg = 36

,

FundShareClass = 37

, FlexibleLoan = 38

} |

| | The available values are: QuotedSecurity, InterestRateSwap, FxForward, Future, ExoticInstrument, FxOption, CreditDefaultSwap, InterestRateSwaption, Bond, EquityOption, FixedLeg, FloatingLeg, BespokeCashFlowsLeg, Unknown, TermDeposit, ContractForDifference, EquitySwap, CashPerpetual, CapFloor, CashSettled, CdsIndex, Basket, FundingLeg, FxSwap, ForwardRateAgreement, SimpleInstrument, Repo, Equity, ExchangeTradedOption, ReferenceInstrument, ComplexBond, InflationLinkedBond, InflationSwap, SimpleCashFlowLoan, TotalReturnSwap, InflationLeg, FundShareClass, FlexibleLoan More...

|

| |

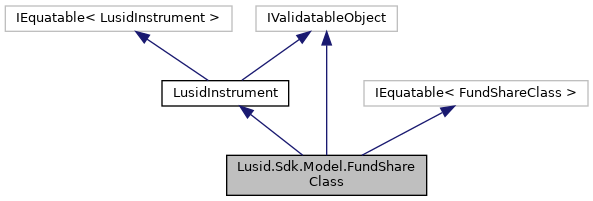

LUSID representation of a FundShareClass. A ShareClass represents a pool of shares, held by investors, within a fund. A ShareClass can represent a differing investment approach by either Fees, Income, Currency Risk and Investor type.

| string Lusid.Sdk.Model.FundShareClass.DistributionPaymentType |

|

getset |

The tax treatment applied to any distributions calculated within the ShareClass. Can be either 'Net' (Distribution Calculated net of tax) or 'Gross' (Distribution calculated gross of tax). Supported string (enumeration) values are: [Gross, Net].

The tax treatment applied to any distributions calculated within the ShareClass. Can be either 'Net' (Distribution Calculated net of tax) or 'Gross' (Distribution calculated gross of tax). Supported string (enumeration) values are: [Gross, Net].

| string Lusid.Sdk.Model.FundShareClass.FundShareClassType |

|

getset |

The type of distribution that the ShareClass will calculate. Can be either 'Income' or 'Accumulation' - Income classes will pay out and Accumulation classes will retain their ShareClass attributable income. Supported string (enumeration) values are: [Income, Accumulation].

The type of distribution that the ShareClass will calculate. Can be either 'Income' or 'Accumulation' - Income classes will pay out and Accumulation classes will retain their ShareClass attributable income. Supported string (enumeration) values are: [Income, Accumulation].

| string Lusid.Sdk.Model.FundShareClass.Hedging |

|

getset |

A flag to indicate the ShareClass is operating currency hedging as a means to limit currency risk as part of it's investment strategy. Supported string (enumeration) values are: [Invalid, None, ApplyHedging].

A flag to indicate the ShareClass is operating currency hedging as a means to limit currency risk as part of it's investment strategy. Supported string (enumeration) values are: [Invalid, None, ApplyHedging].

| string Lusid.Sdk.Model.FundShareClass.ShortCode |

|

getset |

A short identifier, unique across a single fund, usually made up of the ShareClass components. Eg "A Accumulation Euro Hedged Class" could become "A Acc H EUR".

A short identifier, unique across a single fund, usually made up of the ShareClass components. Eg "A Accumulation Euro Hedged Class" could become "A Acc H EUR".

Public Member Functions inherited from Lusid.Sdk.Model.LusidInstrument

Public Member Functions inherited from Lusid.Sdk.Model.LusidInstrument Protected Member Functions inherited from Lusid.Sdk.Model.LusidInstrument

Protected Member Functions inherited from Lusid.Sdk.Model.LusidInstrument Properties inherited from Lusid.Sdk.Model.LusidInstrument

Properties inherited from Lusid.Sdk.Model.LusidInstrument