|

| | EquityOption (DateTimeOffset startDate=default(DateTimeOffset), DateTimeOffset optionMaturityDate=default(DateTimeOffset), DateTimeOffset optionSettlementDate=default(DateTimeOffset), string deliveryType=default(string), string optionType=default(string), decimal strike=default(decimal), string domCcy=default(string), string underlyingIdentifier=default(string), string code=default(string), string equityOptionType=default(string), decimal? numberOfShares=default(decimal?), Premium premium=default(Premium), string exerciseType=default(string), InstrumentTypeEnum instrumentType=default(InstrumentTypeEnum)) |

| | Initializes a new instance of the EquityOption class. More...

|

| |

| override string | ToString () |

| | Returns the string presentation of the object More...

|

| |

| override string | ToJson () |

| | Returns the JSON string presentation of the object More...

|

| |

| override bool | Equals (object input) |

| | Returns true if objects are equal More...

|

| |

| bool | Equals (EquityOption input) |

| | Returns true if EquityOption instances are equal More...

|

| |

| override int | GetHashCode () |

| | Gets the hash code More...

|

| |

| | LusidInstrument (InstrumentTypeEnum instrumentType=default(InstrumentTypeEnum)) |

| | Initializes a new instance of the LusidInstrument class. More...

|

| |

| override string | ToString () |

| | Returns the string presentation of the object More...

|

| |

| override bool | Equals (object input) |

| | Returns true if objects are equal More...

|

| |

| bool | Equals (LusidInstrument input) |

| | Returns true if LusidInstrument instances are equal More...

|

| |

| override int | GetHashCode () |

| | Gets the hash code More...

|

| |

|

| DateTimeOffset | StartDate [get, set] |

| | The start date of the instrument. This is normally synonymous with the trade-date. More...

|

| |

| DateTimeOffset | OptionMaturityDate [get, set] |

| | The maturity date of the option. More...

|

| |

| DateTimeOffset | OptionSettlementDate [get, set] |

| | The settlement date of the option. More...

|

| |

| string | DeliveryType [get, set] |

| | Is the option cash settled or physical delivery of option Supported string (enumeration) values are: [Cash, Physical]. More...

|

| |

| string | OptionType [get, set] |

| | Type of optionality for the option Supported string (enumeration) values are: [Call, Put]. More...

|

| |

| decimal | Strike [get, set] |

| | The strike of the option. More...

|

| |

| string | DomCcy [get, set] |

| | The domestic currency of the instrument. More...

|

| |

| string | UnderlyingIdentifier [get, set] |

| | The market identifier type of the underlying code, e.g RIC. Supported string (enumeration) values are: [LusidInstrumentId, Isin, Sedol, Cusip, ClientInternal, Figi, RIC, QuotePermId, REDCode, BBGId, ICECode]. More...

|

| |

| string | Code [get, set] |

| | The identifying code for the equity underlying, e.g. 'IBM.N'. More...

|

| |

| string | EquityOptionType [get, set] |

| | Equity option types. E.g. Vanilla (default), RightsIssue, Warrant. Supported string (enumeration) values are: [Vanilla, RightsIssue, Warrant]. More...

|

| |

| decimal? | NumberOfShares [get, set] |

| | The amount of shares to exchange if the option is exercised. More...

|

| |

| Premium | Premium [get, set] |

| | Gets or Sets Premium More...

|

| |

| string | ExerciseType [get, set] |

| | Type of optionality that is present; European, American. Supported string (enumeration) values are: [European, American]. More...

|

| |

| InstrumentTypeEnum | InstrumentType [get, set] |

| | The available values are: QuotedSecurity, InterestRateSwap, FxForward, Future, ExoticInstrument, FxOption, CreditDefaultSwap, InterestRateSwaption, Bond, EquityOption, FixedLeg, FloatingLeg, BespokeCashFlowsLeg, Unknown, TermDeposit, ContractForDifference, EquitySwap, CashPerpetual, CapFloor, CashSettled, CdsIndex, Basket, FundingLeg, FxSwap, ForwardRateAgreement, SimpleInstrument, Repo, Equity, ExchangeTradedOption, ReferenceInstrument, ComplexBond, InflationLinkedBond, InflationSwap, SimpleCashFlowLoan, TotalReturnSwap, InflationLeg, FundShareClass, FlexibleLoan More...

|

| |

|

| enum class | InstrumentTypeEnum {

QuotedSecurity = 1

, InterestRateSwap = 2

, FxForward = 3

, Future = 4

,

ExoticInstrument = 5

, FxOption = 6

, CreditDefaultSwap = 7

, InterestRateSwaption = 8

,

Bond = 9

, EquityOption = 10

, FixedLeg = 11

, FloatingLeg = 12

,

BespokeCashFlowsLeg = 13

, Unknown = 14

, TermDeposit = 15

, ContractForDifference = 16

,

EquitySwap = 17

, CashPerpetual = 18

, CapFloor = 19

, CashSettled = 20

,

CdsIndex = 21

, Basket = 22

, FundingLeg = 23

, FxSwap = 24

,

ForwardRateAgreement = 25

, SimpleInstrument = 26

, Repo = 27

, Equity = 28

,

ExchangeTradedOption = 29

, ReferenceInstrument = 30

, ComplexBond = 31

, InflationLinkedBond = 32

,

InflationSwap = 33

, SimpleCashFlowLoan = 34

, TotalReturnSwap = 35

, InflationLeg = 36

,

FundShareClass = 37

, FlexibleLoan = 38

} |

| | The available values are: QuotedSecurity, InterestRateSwap, FxForward, Future, ExoticInstrument, FxOption, CreditDefaultSwap, InterestRateSwaption, Bond, EquityOption, FixedLeg, FloatingLeg, BespokeCashFlowsLeg, Unknown, TermDeposit, ContractForDifference, EquitySwap, CashPerpetual, CapFloor, CashSettled, CdsIndex, Basket, FundingLeg, FxSwap, ForwardRateAgreement, SimpleInstrument, Repo, Equity, ExchangeTradedOption, ReferenceInstrument, ComplexBond, InflationLinkedBond, InflationSwap, SimpleCashFlowLoan, TotalReturnSwap, InflationLeg, FundShareClass, FlexibleLoan More...

|

| |

LUSID representation of a plain vanilla OTC Equity Option.

| string Lusid.Sdk.Model.EquityOption.EquityOptionType |

|

getset |

Equity option types. E.g. Vanilla (default), RightsIssue, Warrant. Supported string (enumeration) values are: [Vanilla, RightsIssue, Warrant].

Equity option types. E.g. Vanilla (default), RightsIssue, Warrant. Supported string (enumeration) values are: [Vanilla, RightsIssue, Warrant].

| string Lusid.Sdk.Model.EquityOption.ExerciseType |

|

getset |

Type of optionality that is present; European, American. Supported string (enumeration) values are: [European, American].

Type of optionality that is present; European, American. Supported string (enumeration) values are: [European, American].

| string Lusid.Sdk.Model.EquityOption.UnderlyingIdentifier |

|

getset |

The market identifier type of the underlying code, e.g RIC. Supported string (enumeration) values are: [LusidInstrumentId, Isin, Sedol, Cusip, ClientInternal, Figi, RIC, QuotePermId, REDCode, BBGId, ICECode].

The market identifier type of the underlying code, e.g RIC. Supported string (enumeration) values are: [LusidInstrumentId, Isin, Sedol, Cusip, ClientInternal, Figi, RIC, QuotePermId, REDCode, BBGId, ICECode].

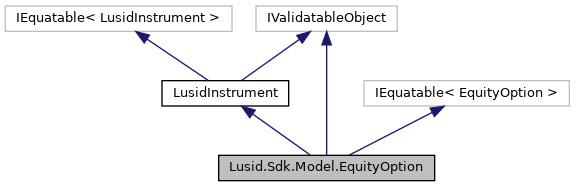

Public Member Functions inherited from Lusid.Sdk.Model.LusidInstrument

Public Member Functions inherited from Lusid.Sdk.Model.LusidInstrument Protected Member Functions inherited from Lusid.Sdk.Model.LusidInstrument

Protected Member Functions inherited from Lusid.Sdk.Model.LusidInstrument Properties inherited from Lusid.Sdk.Model.LusidInstrument

Properties inherited from Lusid.Sdk.Model.LusidInstrument