|

| | EquitySwap (DateTimeOffset startDate=default(DateTimeOffset), DateTimeOffset maturityDate=default(DateTimeOffset), string code=default(string), FlowConventions equityFlowConventions=default(FlowConventions), InstrumentLeg fundingLeg=default(InstrumentLeg), bool includeDividends=default(bool), decimal initialPrice=default(decimal), bool notionalReset=default(bool), decimal quantity=default(decimal), string underlyingIdentifier=default(string), string equitySwapDividendPaymentTiming=default(string), InstrumentTypeEnum instrumentType=default(InstrumentTypeEnum)) |

| | Initializes a new instance of the EquitySwap class. More...

|

| |

| override string | ToString () |

| | Returns the string presentation of the object More...

|

| |

| override string | ToJson () |

| | Returns the JSON string presentation of the object More...

|

| |

| override bool | Equals (object input) |

| | Returns true if objects are equal More...

|

| |

| bool | Equals (EquitySwap input) |

| | Returns true if EquitySwap instances are equal More...

|

| |

| override int | GetHashCode () |

| | Gets the hash code More...

|

| |

| | LusidInstrument (InstrumentTypeEnum instrumentType=default(InstrumentTypeEnum)) |

| | Initializes a new instance of the LusidInstrument class. More...

|

| |

| override string | ToString () |

| | Returns the string presentation of the object More...

|

| |

| override bool | Equals (object input) |

| | Returns true if objects are equal More...

|

| |

| bool | Equals (LusidInstrument input) |

| | Returns true if LusidInstrument instances are equal More...

|

| |

| override int | GetHashCode () |

| | Gets the hash code More...

|

| |

|

| DateTimeOffset | StartDate [get, set] |

| | The start date of the EquitySwap. More...

|

| |

| DateTimeOffset | MaturityDate [get, set] |

| | The final maturity date of the instrument. This means the last date on which the instruments makes a payment of any amount. For the avoidance of doubt, that is not necessarily prior to its last sensitivity date for the purposes of risk; e.g. instruments such as Constant Maturity Swaps (CMS) often have sensitivities to rates that may well be observed or set prior to the maturity date, but refer to a termination date beyond it. More...

|

| |

| string | Code [get, set] |

| | The code of the underlying. More...

|

| |

| FlowConventions | EquityFlowConventions [get, set] |

| | Gets or Sets EquityFlowConventions More...

|

| |

| InstrumentLeg | FundingLeg [get, set] |

| | Gets or Sets FundingLeg More...

|

| |

| bool | IncludeDividends [get, set] |

| | Dividend inclusion flag, if true dividends are included in the equity leg (total return). More...

|

| |

| decimal | InitialPrice [get, set] |

| | The initial equity price of the Equity Swap. More...

|

| |

| bool | NotionalReset [get, set] |

| | Notional reset flag, if true the notional of the funding leg is reset at the start of every coupon to match the value of the equity leg (equity price at start of coupon times quantity). More...

|

| |

| decimal | Quantity [get, set] |

| | The quantity or number of shares in the Equity Swap. More...

|

| |

| string | UnderlyingIdentifier [get, set] |

| | External market codes and identifiers for the EquitySwap, e.g. RIC. Supported string (enumeration) values are: [LusidInstrumentId, Isin, Sedol, Cusip, ClientInternal, Figi, RIC, QuotePermId, REDCode, BBGId, ICECode]. More...

|

| |

| string | EquitySwapDividendPaymentTiming [get, set] |

| | Determines how the payment of dividends is handled for the equity swap. Defaults to paying at the next Equity coupon date. Supported string (enumeration) values are: [PayAtNextEquityCouponDate, PayAtMaturityOfSwap, PayAtNextFundingLegCouponDate, PayAtPaymentDateOfDividendEvent]. More...

|

| |

| InstrumentTypeEnum | InstrumentType [get, set] |

| | The available values are: QuotedSecurity, InterestRateSwap, FxForward, Future, ExoticInstrument, FxOption, CreditDefaultSwap, InterestRateSwaption, Bond, EquityOption, FixedLeg, FloatingLeg, BespokeCashFlowsLeg, Unknown, TermDeposit, ContractForDifference, EquitySwap, CashPerpetual, CapFloor, CashSettled, CdsIndex, Basket, FundingLeg, FxSwap, ForwardRateAgreement, SimpleInstrument, Repo, Equity, ExchangeTradedOption, ReferenceInstrument, ComplexBond, InflationLinkedBond, InflationSwap, SimpleCashFlowLoan, TotalReturnSwap, InflationLeg, FundShareClass, FlexibleLoan More...

|

| |

|

| enum class | InstrumentTypeEnum {

QuotedSecurity = 1

, InterestRateSwap = 2

, FxForward = 3

, Future = 4

,

ExoticInstrument = 5

, FxOption = 6

, CreditDefaultSwap = 7

, InterestRateSwaption = 8

,

Bond = 9

, EquityOption = 10

, FixedLeg = 11

, FloatingLeg = 12

,

BespokeCashFlowsLeg = 13

, Unknown = 14

, TermDeposit = 15

, ContractForDifference = 16

,

EquitySwap = 17

, CashPerpetual = 18

, CapFloor = 19

, CashSettled = 20

,

CdsIndex = 21

, Basket = 22

, FundingLeg = 23

, FxSwap = 24

,

ForwardRateAgreement = 25

, SimpleInstrument = 26

, Repo = 27

, Equity = 28

,

ExchangeTradedOption = 29

, ReferenceInstrument = 30

, ComplexBond = 31

, InflationLinkedBond = 32

,

InflationSwap = 33

, SimpleCashFlowLoan = 34

, TotalReturnSwap = 35

, InflationLeg = 36

,

FundShareClass = 37

, FlexibleLoan = 38

} |

| | The available values are: QuotedSecurity, InterestRateSwap, FxForward, Future, ExoticInstrument, FxOption, CreditDefaultSwap, InterestRateSwaption, Bond, EquityOption, FixedLeg, FloatingLeg, BespokeCashFlowsLeg, Unknown, TermDeposit, ContractForDifference, EquitySwap, CashPerpetual, CapFloor, CashSettled, CdsIndex, Basket, FundingLeg, FxSwap, ForwardRateAgreement, SimpleInstrument, Repo, Equity, ExchangeTradedOption, ReferenceInstrument, ComplexBond, InflationLinkedBond, InflationSwap, SimpleCashFlowLoan, TotalReturnSwap, InflationLeg, FundShareClass, FlexibleLoan More...

|

| |

LUSID representation of an Equity Swap. This instrument has multiple legs, to see how legs are used in LUSID see knowledge base article KA-02252. | Leg Index | Leg Identifier | Description | | - – – – – | - – – – – – – - | - – – – – – | | 1 | EquityLeg | Cash flows relating to the performance of the underlying equity. | | 2 | FundingLeg | The funding leg of the swap. | | 3 | EquityDividendLeg | Cash flows relating to dividend payments on the underlying equity (optional). |

| string Lusid.Sdk.Model.EquitySwap.EquitySwapDividendPaymentTiming |

|

getset |

Determines how the payment of dividends is handled for the equity swap. Defaults to paying at the next Equity coupon date. Supported string (enumeration) values are: [PayAtNextEquityCouponDate, PayAtMaturityOfSwap, PayAtNextFundingLegCouponDate, PayAtPaymentDateOfDividendEvent].

Determines how the payment of dividends is handled for the equity swap. Defaults to paying at the next Equity coupon date. Supported string (enumeration) values are: [PayAtNextEquityCouponDate, PayAtMaturityOfSwap, PayAtNextFundingLegCouponDate, PayAtPaymentDateOfDividendEvent].

| DateTimeOffset Lusid.Sdk.Model.EquitySwap.MaturityDate |

|

getset |

The final maturity date of the instrument. This means the last date on which the instruments makes a payment of any amount. For the avoidance of doubt, that is not necessarily prior to its last sensitivity date for the purposes of risk; e.g. instruments such as Constant Maturity Swaps (CMS) often have sensitivities to rates that may well be observed or set prior to the maturity date, but refer to a termination date beyond it.

The final maturity date of the instrument. This means the last date on which the instruments makes a payment of any amount. For the avoidance of doubt, that is not necessarily prior to its last sensitivity date for the purposes of risk; e.g. instruments such as Constant Maturity Swaps (CMS) often have sensitivities to rates that may well be observed or set prior to the maturity date, but refer to a termination date beyond it.

| string Lusid.Sdk.Model.EquitySwap.UnderlyingIdentifier |

|

getset |

External market codes and identifiers for the EquitySwap, e.g. RIC. Supported string (enumeration) values are: [LusidInstrumentId, Isin, Sedol, Cusip, ClientInternal, Figi, RIC, QuotePermId, REDCode, BBGId, ICECode].

External market codes and identifiers for the EquitySwap, e.g. RIC. Supported string (enumeration) values are: [LusidInstrumentId, Isin, Sedol, Cusip, ClientInternal, Figi, RIC, QuotePermId, REDCode, BBGId, ICECode].

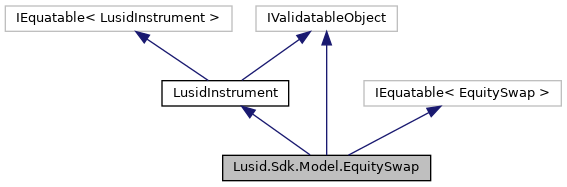

Public Member Functions inherited from Lusid.Sdk.Model.LusidInstrument

Public Member Functions inherited from Lusid.Sdk.Model.LusidInstrument Protected Member Functions inherited from Lusid.Sdk.Model.LusidInstrument

Protected Member Functions inherited from Lusid.Sdk.Model.LusidInstrument Properties inherited from Lusid.Sdk.Model.LusidInstrument

Properties inherited from Lusid.Sdk.Model.LusidInstrument