|

| | InflationLeg (DateTimeOffset startDate=default(DateTimeOffset), DateTimeOffset maturityDate=default(DateTimeOffset), FlowConventions flowConventions=default(FlowConventions), decimal? baseCPI=default(decimal?), string calculationType=default(string), decimal? capRate=default(decimal?), decimal? floorRate=default(decimal?), InflationIndexConventions inflationIndexConventions=default(InflationIndexConventions), decimal notional=default(decimal), string payReceive=default(string), InstrumentTypeEnum instrumentType=default(InstrumentTypeEnum)) |

| | Initializes a new instance of the InflationLeg class. More...

|

| |

| override string | ToString () |

| | Returns the string presentation of the object More...

|

| |

| override string | ToJson () |

| | Returns the JSON string presentation of the object More...

|

| |

| override bool | Equals (object input) |

| | Returns true if objects are equal More...

|

| |

| bool | Equals (InflationLeg input) |

| | Returns true if InflationLeg instances are equal More...

|

| |

| override int | GetHashCode () |

| | Gets the hash code More...

|

| |

| | LusidInstrument (InstrumentTypeEnum instrumentType=default(InstrumentTypeEnum)) |

| | Initializes a new instance of the LusidInstrument class. More...

|

| |

| override string | ToString () |

| | Returns the string presentation of the object More...

|

| |

| override bool | Equals (object input) |

| | Returns true if objects are equal More...

|

| |

| bool | Equals (LusidInstrument input) |

| | Returns true if LusidInstrument instances are equal More...

|

| |

| override int | GetHashCode () |

| | Gets the hash code More...

|

| |

|

| DateTimeOffset | StartDate [get, set] |

| | The start date of the instrument. This is normally synonymous with the trade-date. More...

|

| |

| DateTimeOffset | MaturityDate [get, set] |

| | The final maturity date of the instrument. This means the last date on which the instruments makes a payment of any amount. For the avoidance of doubt, that is not necessarily prior to its last sensitivity date for the purposes of risk; e.g. instruments such as Constant Maturity Swaps (CMS) often have sensitivities to rates that may well be observed or set prior to the maturity date, but refer to a termination date beyond it. More...

|

| |

| FlowConventions | FlowConventions [get, set] |

| | Gets or Sets FlowConventions More...

|

| |

| decimal? | BaseCPI [get, set] |

| | Optional BaseCPI, if specified it will be used in place of BaseCPI(StartDate). This should not be required for standard inflation swaps. More...

|

| |

| string | CalculationType [get, set] |

| | The calculation type. ZeroCoupon is used for CPILegs where there is a single payment at maturity of Notional * (CPI(T) / CPI(T0) - 1) where CPI(T0) is the BaseCPI of this leg YearOnYear is used for YoY and LPI swap legs where there is a series of annual payments Notional * dayCount * (CPI(t) / CPI(t-1) - 1) If a cap and floor is added to this it becomes an LPI swap leg. Compounded is used for inflation swap legs where there is a series of annual payments Notional * dayCount * (CPI(t) / CPI(T0) - 1) i.e. the BaseCPI is used every year. These swaps are not as common as CPI or Supported string (enumeration) values are: [ZeroCoupon, YearOnYear, Compounded]. More...

|

| |

| decimal? | CapRate [get, set] |

| | Optional cap, needed for LPI Legs or CPI Legs with Caps More...

|

| |

| decimal? | FloorRate [get, set] |

| | Optional floor, needed for LPI Legs or CPI Legs with Floors. More...

|

| |

| InflationIndexConventions | InflationIndexConventions [get, set] |

| | Gets or Sets InflationIndexConventions More...

|

| |

| decimal | Notional [get, set] |

| | The notional More...

|

| |

| string | PayReceive [get, set] |

| | PayReceive flag for the inflation leg. This field is optional and defaults to Pay. Supported string (enumeration) values are: [Pay, Receive]. More...

|

| |

| InstrumentTypeEnum | InstrumentType [get, set] |

| | The available values are: QuotedSecurity, InterestRateSwap, FxForward, Future, ExoticInstrument, FxOption, CreditDefaultSwap, InterestRateSwaption, Bond, EquityOption, FixedLeg, FloatingLeg, BespokeCashFlowsLeg, Unknown, TermDeposit, ContractForDifference, EquitySwap, CashPerpetual, CapFloor, CashSettled, CdsIndex, Basket, FundingLeg, FxSwap, ForwardRateAgreement, SimpleInstrument, Repo, Equity, ExchangeTradedOption, ReferenceInstrument, ComplexBond, InflationLinkedBond, InflationSwap, SimpleCashFlowLoan, TotalReturnSwap, InflationLeg, FundShareClass, FlexibleLoan More...

|

| |

|

| enum class | InstrumentTypeEnum {

QuotedSecurity = 1

, InterestRateSwap = 2

, FxForward = 3

, Future = 4

,

ExoticInstrument = 5

, FxOption = 6

, CreditDefaultSwap = 7

, InterestRateSwaption = 8

,

Bond = 9

, EquityOption = 10

, FixedLeg = 11

, FloatingLeg = 12

,

BespokeCashFlowsLeg = 13

, Unknown = 14

, TermDeposit = 15

, ContractForDifference = 16

,

EquitySwap = 17

, CashPerpetual = 18

, CapFloor = 19

, CashSettled = 20

,

CdsIndex = 21

, Basket = 22

, FundingLeg = 23

, FxSwap = 24

,

ForwardRateAgreement = 25

, SimpleInstrument = 26

, Repo = 27

, Equity = 28

,

ExchangeTradedOption = 29

, ReferenceInstrument = 30

, ComplexBond = 31

, InflationLinkedBond = 32

,

InflationSwap = 33

, SimpleCashFlowLoan = 34

, TotalReturnSwap = 35

, InflationLeg = 36

,

FundShareClass = 37

, FlexibleLoan = 38

} |

| | The available values are: QuotedSecurity, InterestRateSwap, FxForward, Future, ExoticInstrument, FxOption, CreditDefaultSwap, InterestRateSwaption, Bond, EquityOption, FixedLeg, FloatingLeg, BespokeCashFlowsLeg, Unknown, TermDeposit, ContractForDifference, EquitySwap, CashPerpetual, CapFloor, CashSettled, CdsIndex, Basket, FundingLeg, FxSwap, ForwardRateAgreement, SimpleInstrument, Repo, Equity, ExchangeTradedOption, ReferenceInstrument, ComplexBond, InflationLinkedBond, InflationSwap, SimpleCashFlowLoan, TotalReturnSwap, InflationLeg, FundShareClass, FlexibleLoan More...

|

| |

LUSID representation of an Inflation Leg. This leg instrument is part of the InflationSwap instrument, but can also be used as a standalone instrument. The implementation supports the following inflation leg types: * Zero Coupon inflation leg (CPI Leg), with a single payment at maturity. * Year on Year inflation leg * LPI Swap Leg (capped and floored YoY)

| string Lusid.Sdk.Model.InflationLeg.CalculationType |

|

getset |

The calculation type. ZeroCoupon is used for CPILegs where there is a single payment at maturity of Notional * (CPI(T) / CPI(T0) - 1) where CPI(T0) is the BaseCPI of this leg YearOnYear is used for YoY and LPI swap legs where there is a series of annual payments Notional * dayCount * (CPI(t) / CPI(t-1) - 1) If a cap and floor is added to this it becomes an LPI swap leg. Compounded is used for inflation swap legs where there is a series of annual payments Notional * dayCount * (CPI(t) / CPI(T0) - 1) i.e. the BaseCPI is used every year. These swaps are not as common as CPI or Supported string (enumeration) values are: [ZeroCoupon, YearOnYear, Compounded].

The calculation type. ZeroCoupon is used for CPILegs where there is a single payment at maturity of Notional * (CPI(T) / CPI(T0) - 1) where CPI(T0) is the BaseCPI of this leg YearOnYear is used for YoY and LPI swap legs where there is a series of annual payments Notional * dayCount * (CPI(t) / CPI(t-1) - 1) If a cap and floor is added to this it becomes an LPI swap leg. Compounded is used for inflation swap legs where there is a series of annual payments Notional * dayCount * (CPI(t) / CPI(T0) - 1) i.e. the BaseCPI is used every year. These swaps are not as common as CPI or Supported string (enumeration) values are: [ZeroCoupon, YearOnYear, Compounded].

| DateTimeOffset Lusid.Sdk.Model.InflationLeg.MaturityDate |

|

getset |

The final maturity date of the instrument. This means the last date on which the instruments makes a payment of any amount. For the avoidance of doubt, that is not necessarily prior to its last sensitivity date for the purposes of risk; e.g. instruments such as Constant Maturity Swaps (CMS) often have sensitivities to rates that may well be observed or set prior to the maturity date, but refer to a termination date beyond it.

The final maturity date of the instrument. This means the last date on which the instruments makes a payment of any amount. For the avoidance of doubt, that is not necessarily prior to its last sensitivity date for the purposes of risk; e.g. instruments such as Constant Maturity Swaps (CMS) often have sensitivities to rates that may well be observed or set prior to the maturity date, but refer to a termination date beyond it.

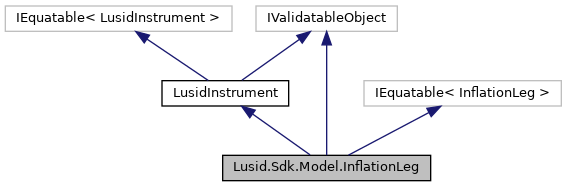

Public Member Functions inherited from Lusid.Sdk.Model.LusidInstrument

Public Member Functions inherited from Lusid.Sdk.Model.LusidInstrument Protected Member Functions inherited from Lusid.Sdk.Model.LusidInstrument

Protected Member Functions inherited from Lusid.Sdk.Model.LusidInstrument Properties inherited from Lusid.Sdk.Model.LusidInstrument

Properties inherited from Lusid.Sdk.Model.LusidInstrument