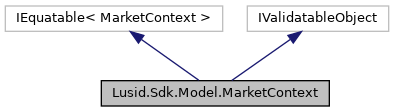

Market context node. This defines how LUSID processes parts of a request that require resolution of market data such as instrument prices or Fx rates. It controls where the data is loaded from and which sources take precedence.

More...

|

| List< MarketDataKeyRule > | MarketRules [get, set] |

| | The set of rules that define how to resolve particular use cases. These can be relatively general or specific in nature. Nominally any number are possible and will be processed in order where applicable. However, there is evidently a potential for increased computational cost where many rules must be applied to resolve data. Ensuring that portfolios are structured in such a way as to reduce the number of rules required is therefore sensible. More...

|

| |

| MarketContextSuppliers | Suppliers [get, set] |

| | Gets or Sets Suppliers More...

|

| |

| MarketOptions | Options [get, set] |

| | Gets or Sets Options More...

|

| |

| List< MarketDataSpecificRule > | SpecificRules [get, set] |

| | Extends market data key rules to be able to catch dependencies depending on where the dependency comes from, as opposed to what the dependency is asking for. Using two specific rules, one could instruct rates curves requested by bonds to be retrieved from a different scope than rates curves requested by swaps. WARNING: The use of specific rules impacts performance. Where possible, one should use MarketDataKeyRules only. More...

|

| |

| List< GroupOfMarketDataKeyRules > | GroupedMarketRules [get, set] |

| | The list of groups of rules that will be used in market data resolution. Rules given within a group will, if the group is being used to resolve data, all be applied with the results of those individual resolution attempts combined into a single result. The method for combining results is determined by the operation detailed in the GroupOfMarketDataKeyRules. Notes: - When resolving MarketData, MarketRules will be applied first followed by GroupedMarketRules if data could not be found using only the MarketRules provided. - GroupedMarketRules can only be used for resolving data from the QuoteStore. Caution: As every rule in a given group will be applied in resolution if the group is applied, groups are computationally expensive for market data resolution. Therefore, heuristically, rule groups should be kept as small as possible. More...

|

| |

Market context node. This defines how LUSID processes parts of a request that require resolution of market data such as instrument prices or Fx rates. It controls where the data is loaded from and which sources take precedence.

◆ MarketContext()

Initializes a new instance of the MarketContext class.

- Parameters

-

| marketRules | The set of rules that define how to resolve particular use cases. These can be relatively general or specific in nature. Nominally any number are possible and will be processed in order where applicable. However, there is evidently a potential for increased computational cost where many rules must be applied to resolve data. Ensuring that portfolios are structured in such a way as to reduce the number of rules required is therefore sensible.. |

| suppliers | suppliers. |

| options | options. |

| specificRules | Extends market data key rules to be able to catch dependencies depending on where the dependency comes from, as opposed to what the dependency is asking for. Using two specific rules, one could instruct rates curves requested by bonds to be retrieved from a different scope than rates curves requested by swaps. WARNING: The use of specific rules impacts performance. Where possible, one should use MarketDataKeyRules only.. |

| groupedMarketRules | The list of groups of rules that will be used in market data resolution. Rules given within a group will, if the group is being used to resolve data, all be applied with the results of those individual resolution attempts combined into a single result. The method for combining results is determined by the operation detailed in the GroupOfMarketDataKeyRules. Notes: - When resolving MarketData, MarketRules will be applied first followed by GroupedMarketRules if data could not be found using only the MarketRules provided. - GroupedMarketRules can only be used for resolving data from the QuoteStore. Caution: As every rule in a given group will be applied in resolution if the group is applied, groups are computationally expensive for market data resolution. Therefore, heuristically, rule groups should be kept as small as possible.. |

◆ Equals() [1/2]

Returns true if MarketContext instances are equal

- Parameters

-

- Returns

- Boolean

◆ Equals() [2/2]

| override bool Lusid.Sdk.Model.MarketContext.Equals |

( |

object |

input | ) |

|

|

inline |

Returns true if objects are equal

- Parameters

-

| input | Object to be compared |

- Returns

- Boolean

◆ GetHashCode()

| override int Lusid.Sdk.Model.MarketContext.GetHashCode |

( |

| ) |

|

|

inline |

Gets the hash code

- Returns

- Hash code

◆ ToJson()

| virtual string Lusid.Sdk.Model.MarketContext.ToJson |

( |

| ) |

|

|

inlinevirtual |

Returns the JSON string presentation of the object

- Returns

- JSON string presentation of the object

◆ ToString()

| override string Lusid.Sdk.Model.MarketContext.ToString |

( |

| ) |

|

|

inline |

Returns the string presentation of the object

- Returns

- String presentation of the object

◆ GroupedMarketRules

The list of groups of rules that will be used in market data resolution. Rules given within a group will, if the group is being used to resolve data, all be applied with the results of those individual resolution attempts combined into a single result. The method for combining results is determined by the operation detailed in the GroupOfMarketDataKeyRules. Notes: - When resolving MarketData, MarketRules will be applied first followed by GroupedMarketRules if data could not be found using only the MarketRules provided. - GroupedMarketRules can only be used for resolving data from the QuoteStore. Caution: As every rule in a given group will be applied in resolution if the group is applied, groups are computationally expensive for market data resolution. Therefore, heuristically, rule groups should be kept as small as possible.

The list of groups of rules that will be used in market data resolution. Rules given within a group will, if the group is being used to resolve data, all be applied with the results of those individual resolution attempts combined into a single result. The method for combining results is determined by the operation detailed in the GroupOfMarketDataKeyRules. Notes: - When resolving MarketData, MarketRules will be applied first followed by GroupedMarketRules if data could not be found using only the MarketRules provided. - GroupedMarketRules can only be used for resolving data from the QuoteStore. Caution: As every rule in a given group will be applied in resolution if the group is applied, groups are computationally expensive for market data resolution. Therefore, heuristically, rule groups should be kept as small as possible.

◆ MarketRules

The set of rules that define how to resolve particular use cases. These can be relatively general or specific in nature. Nominally any number are possible and will be processed in order where applicable. However, there is evidently a potential for increased computational cost where many rules must be applied to resolve data. Ensuring that portfolios are structured in such a way as to reduce the number of rules required is therefore sensible.

The set of rules that define how to resolve particular use cases. These can be relatively general or specific in nature. Nominally any number are possible and will be processed in order where applicable. However, there is evidently a potential for increased computational cost where many rules must be applied to resolve data. Ensuring that portfolios are structured in such a way as to reduce the number of rules required is therefore sensible.

◆ Options

◆ SpecificRules

Extends market data key rules to be able to catch dependencies depending on where the dependency comes from, as opposed to what the dependency is asking for. Using two specific rules, one could instruct rates curves requested by bonds to be retrieved from a different scope than rates curves requested by swaps. WARNING: The use of specific rules impacts performance. Where possible, one should use MarketDataKeyRules only.

Extends market data key rules to be able to catch dependencies depending on where the dependency comes from, as opposed to what the dependency is asking for. Using two specific rules, one could instruct rates curves requested by bonds to be retrieved from a different scope than rates curves requested by swaps. WARNING: The use of specific rules impacts performance. Where possible, one should use MarketDataKeyRules only.

◆ Suppliers

The documentation for this class was generated from the following file:

- /home/docs/checkouts/readthedocs.org/user_builds/lusid-sdk-csharp/checkouts/latest/sdk/Lusid.Sdk/Model/MarketContext.cs