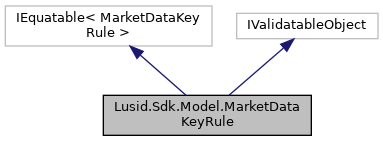

When performing analytics, instruments and models have dependencies on market data. A market data key rule essentially tells lusid to "resolve dependencies matching the pattern 'X' using data of the form 'Y'". The parameter 'X' is defined by the key of the key rule, and might specify "all USD rates curves" or "all RIC-based prices". The parameter 'Y' is defined by the remaining fields of the key rule, and allows the user to configure things such as where to look for data, what sort of data should be looked for (e.g. bid/mid/ask), and how old the data is allowed to be.

More...

|

| enum class | QuoteTypeEnum {

Price = 1

, Spread = 2

, Rate = 3

, LogNormalVol = 4

,

NormalVol = 5

, ParSpread = 6

, IsdaSpread = 7

, Upfront = 8

,

Index = 9

, Ratio = 10

, Delta = 11

, PoolFactor = 12

,

InflationAssumption = 13

, DirtyPrice = 14

} |

| | The available values are: Price, Spread, Rate, LogNormalVol, NormalVol, ParSpread, IsdaSpread, Upfront, Index, Ratio, Delta, PoolFactor, InflationAssumption, DirtyPrice More...

|

| |

|

| QuoteTypeEnum | QuoteType [get, set] |

| | The available values are: Price, Spread, Rate, LogNormalVol, NormalVol, ParSpread, IsdaSpread, Upfront, Index, Ratio, Delta, PoolFactor, InflationAssumption, DirtyPrice More...

|

| |

| string | Key [get, set] |

| | A dot-separated string that defines a pattern for matching market data dependencies. The form of the string depends on the type of the dependency; see below for basic types and the Knowledge Base for further info. Quote lookup: "Quote.{CodeType}.*" e.g. "Quote.RIC.*" refers to 'any RIC quote' Fx rates: "Fx.CurrencyPair.*", which refers to 'any FX rate' Discounting curves: "Rates.{Currency}.{Currency}OIS e.g. "Rates.USD.USDOIS" refers to the OIS USD discounting curve For non-fx and non-quote rules, trailing parameters can be replaced by the wildcard character ''. e.g. "Rates..*" matches any dependency on a discounting curve. More...

|

| |

| string | Supplier [get, set] |

| | The market data supplier (where the data comes from) More...

|

| |

| string | DataScope [get, set] |

| | The scope in which the data should be found when using this rule. More...

|

| |

| string | Field [get, set] |

| | The conceptual qualification for the field, typically 'bid', 'mid' (default), or 'ask', but can also be 'open', 'close', etc. When resolving quotes from LUSID's database, only quotes whose Field is identical to the Field specified here will be accepted as market data. When resolving data from an external supplier, the Field must be one of a defined set for the given supplier. Note: Applies to the retrieval of quotes only. Has no impact on the resolution of complex market data. More...

|

| |

| string | QuoteInterval [get, set] |

| | Shorthand for the time interval used to select market data. This must be a dot-separated string nominating a start and end date, for example '5D.0D' to look back 5 days from today (0 days ago). The syntax is <i>int</i><i>char</i>.<i>int</i><i>char</i>, where <i>char</i> is one of D(ay), Bd(business day), W(eek), M(onth) or Y(ear). Business days are calculated using the calendars specified on the Valuation Request. If no calendar is provided in the request, then it will default to only skipping weekends. For example, if the valuation date is a Monday, then a quote interval of "1Bd" would behave as "3D", looking back to the Friday. Data with effectiveAt on the weekend will still be found in that window. More...

|

| |

| DateTimeOffset? | AsAt [get, set] |

| | The AsAt predicate specification. More...

|

| |

| string | PriceSource [get, set] |

| | The source of the quote. For a given provider/supplier of market data there may be an additional qualifier, e.g. the exchange or bank that provided the quote More...

|

| |

| string | Mask [get, set] |

| | Allows for partial or complete override of the market asset resolved for a dependency Either a named override or a dot separated string (A.B.C.D.*). e.g. for Rates curve 'EUR.*' will replace the resolve MarketAsset 'GBP/12M', 'GBP/3M' with the EUR equivalent, if there are no wildcards in the mask, the mask is taken as the MarketAsset for any dependency matching the rule. More...

|

| |

| string | SourceSystem [get, set] |

| | If set, this parameter will seek an external source of market data. Optional and, if omitted, will default to "Lusid". This means that data will be retrieved from the LUSID Quote Store and LUSID Complex Market Data Store. This can be set to "MarketDataOverrides" if Supplier is set to "Client". More...

|

| |

When performing analytics, instruments and models have dependencies on market data. A market data key rule essentially tells lusid to "resolve dependencies matching the pattern 'X' using data of the form 'Y'". The parameter 'X' is defined by the key of the key rule, and might specify "all USD rates curves" or "all RIC-based prices". The parameter 'Y' is defined by the remaining fields of the key rule, and allows the user to configure things such as where to look for data, what sort of data should be looked for (e.g. bid/mid/ask), and how old the data is allowed to be.

◆ QuoteTypeEnum

The available values are: Price, Spread, Rate, LogNormalVol, NormalVol, ParSpread, IsdaSpread, Upfront, Index, Ratio, Delta, PoolFactor, InflationAssumption, DirtyPrice

The available values are: Price, Spread, Rate, LogNormalVol, NormalVol, ParSpread, IsdaSpread, Upfront, Index, Ratio, Delta, PoolFactor, InflationAssumption, DirtyPrice

| Enumerator |

|---|

| Price | Enum Price for value: Price

|

| Spread | Enum Spread for value: Spread

|

| Rate | Enum Rate for value: Rate

|

| LogNormalVol | Enum LogNormalVol for value: LogNormalVol

|

| NormalVol | Enum NormalVol for value: NormalVol

|

| ParSpread | Enum ParSpread for value: ParSpread

|

| IsdaSpread | Enum IsdaSpread for value: IsdaSpread

|

| Upfront | Enum Upfront for value: Upfront

|

| Index | Enum Index for value: Index

|

| Ratio | Enum Ratio for value: Ratio

|

| Delta | Enum Delta for value: Delta

|

| PoolFactor | Enum PoolFactor for value: PoolFactor

|

| InflationAssumption | Enum InflationAssumption for value: InflationAssumption

|

| DirtyPrice | Enum DirtyPrice for value: DirtyPrice

|

◆ MarketDataKeyRule() [1/2]

| Lusid.Sdk.Model.MarketDataKeyRule.MarketDataKeyRule |

( |

| ) |

|

|

inlineprotected |

◆ MarketDataKeyRule() [2/2]

| Lusid.Sdk.Model.MarketDataKeyRule.MarketDataKeyRule |

( |

string |

key = default(string), |

|

|

string |

supplier = default(string), |

|

|

string |

dataScope = default(string), |

|

|

QuoteTypeEnum |

quoteType = default(QuoteTypeEnum), |

|

|

string |

field = default(string), |

|

|

string |

quoteInterval = default(string), |

|

|

DateTimeOffset? |

asAt = default(DateTimeOffset?), |

|

|

string |

priceSource = default(string), |

|

|

string |

mask = default(string), |

|

|

string |

sourceSystem = default(string) |

|

) |

| |

|

inline |

Initializes a new instance of the MarketDataKeyRule class.

- Parameters

-

| key | A dot-separated string that defines a pattern for matching market data dependencies. The form of the string depends on the type of the dependency; see below for basic types and the Knowledge Base for further info. Quote lookup: "Quote.{CodeType}.*" e.g. "Quote.RIC.*" refers to 'any RIC quote' Fx rates: "Fx.CurrencyPair.*", which refers to 'any FX rate' Discounting curves: "Rates.{Currency}.{Currency}OIS e.g. "Rates.USD.USDOIS" refers to the OIS USD discounting curve For non-fx and non-quote rules, trailing parameters can be replaced by the wildcard character ''. e.g. "Rates..*" matches any dependency on a discounting curve. (required). |

| supplier | The market data supplier (where the data comes from) (required). |

| dataScope | The scope in which the data should be found when using this rule. (required). |

| quoteType | The available values are: Price, Spread, Rate, LogNormalVol, NormalVol, ParSpread, IsdaSpread, Upfront, Index, Ratio, Delta, PoolFactor, InflationAssumption, DirtyPrice (required). |

| field | The conceptual qualification for the field, typically 'bid', 'mid' (default), or 'ask', but can also be 'open', 'close', etc. When resolving quotes from LUSID's database, only quotes whose Field is identical to the Field specified here will be accepted as market data. When resolving data from an external supplier, the Field must be one of a defined set for the given supplier. Note: Applies to the retrieval of quotes only. Has no impact on the resolution of complex market data.. |

| quoteInterval | Shorthand for the time interval used to select market data. This must be a dot-separated string nominating a start and end date, for example '5D.0D' to look back 5 days from today (0 days ago). The syntax is <i>int</i><i>char</i>.<i>int</i><i>char</i>, where <i>char</i> is one of D(ay), Bd(business day), W(eek), M(onth) or Y(ear). Business days are calculated using the calendars specified on the Valuation Request. If no calendar is provided in the request, then it will default to only skipping weekends. For example, if the valuation date is a Monday, then a quote interval of "1Bd" would behave as "3D", looking back to the Friday. Data with effectiveAt on the weekend will still be found in that window.. |

| asAt | The AsAt predicate specification.. |

| priceSource | The source of the quote. For a given provider/supplier of market data there may be an additional qualifier, e.g. the exchange or bank that provided the quote. |

| mask | Allows for partial or complete override of the market asset resolved for a dependency Either a named override or a dot separated string (A.B.C.D.*). e.g. for Rates curve 'EUR.*' will replace the resolve MarketAsset 'GBP/12M', 'GBP/3M' with the EUR equivalent, if there are no wildcards in the mask, the mask is taken as the MarketAsset for any dependency matching the rule.. |

| sourceSystem | If set, this parameter will seek an external source of market data. Optional and, if omitted, will default to "Lusid". This means that data will be retrieved from the LUSID Quote Store and LUSID Complex Market Data Store. This can be set to "MarketDataOverrides" if Supplier is set to "Client".. |

◆ Equals() [1/2]

◆ Equals() [2/2]

| override bool Lusid.Sdk.Model.MarketDataKeyRule.Equals |

( |

object |

input | ) |

|

|

inline |

Returns true if objects are equal

- Parameters

-

| input | Object to be compared |

- Returns

- Boolean

◆ GetHashCode()

| override int Lusid.Sdk.Model.MarketDataKeyRule.GetHashCode |

( |

| ) |

|

|

inline |

Gets the hash code

- Returns

- Hash code

◆ ToJson()

| virtual string Lusid.Sdk.Model.MarketDataKeyRule.ToJson |

( |

| ) |

|

|

inlinevirtual |

Returns the JSON string presentation of the object

- Returns

- JSON string presentation of the object

◆ ToString()

| override string Lusid.Sdk.Model.MarketDataKeyRule.ToString |

( |

| ) |

|

|

inline |

Returns the string presentation of the object

- Returns

- String presentation of the object

◆ AsAt

| DateTimeOffset? Lusid.Sdk.Model.MarketDataKeyRule.AsAt |

|

getset |

The AsAt predicate specification.

The AsAt predicate specification.

◆ DataScope

| string Lusid.Sdk.Model.MarketDataKeyRule.DataScope |

|

getset |

The scope in which the data should be found when using this rule.

The scope in which the data should be found when using this rule.

◆ Field

| string Lusid.Sdk.Model.MarketDataKeyRule.Field |

|

getset |

The conceptual qualification for the field, typically 'bid', 'mid' (default), or 'ask', but can also be 'open', 'close', etc. When resolving quotes from LUSID's database, only quotes whose Field is identical to the Field specified here will be accepted as market data. When resolving data from an external supplier, the Field must be one of a defined set for the given supplier. Note: Applies to the retrieval of quotes only. Has no impact on the resolution of complex market data.

The conceptual qualification for the field, typically 'bid', 'mid' (default), or 'ask', but can also be 'open', 'close', etc. When resolving quotes from LUSID's database, only quotes whose Field is identical to the Field specified here will be accepted as market data. When resolving data from an external supplier, the Field must be one of a defined set for the given supplier. Note: Applies to the retrieval of quotes only. Has no impact on the resolution of complex market data.

◆ Key

| string Lusid.Sdk.Model.MarketDataKeyRule.Key |

|

getset |

A dot-separated string that defines a pattern for matching market data dependencies. The form of the string depends on the type of the dependency; see below for basic types and the Knowledge Base for further info. Quote lookup: "Quote.{CodeType}.*" e.g. "Quote.RIC.*" refers to 'any RIC quote' Fx rates: "Fx.CurrencyPair.*", which refers to 'any FX rate' Discounting curves: "Rates.{Currency}.{Currency}OIS e.g. "Rates.USD.USDOIS" refers to the OIS USD discounting curve For non-fx and non-quote rules, trailing parameters can be replaced by the wildcard character ''. e.g. "Rates..*" matches any dependency on a discounting curve.

A dot-separated string that defines a pattern for matching market data dependencies. The form of the string depends on the type of the dependency; see below for basic types and the Knowledge Base for further info. Quote lookup: "Quote.{CodeType}.*" e.g. "Quote.RIC.*" refers to 'any RIC quote' Fx rates: "Fx.CurrencyPair.*", which refers to 'any FX rate' Discounting curves: "Rates.{Currency}.{Currency}OIS e.g. "Rates.USD.USDOIS" refers to the OIS USD discounting curve For non-fx and non-quote rules, trailing parameters can be replaced by the wildcard character ''. e.g. "Rates..*" matches any dependency on a discounting curve.

◆ Mask

| string Lusid.Sdk.Model.MarketDataKeyRule.Mask |

|

getset |

Allows for partial or complete override of the market asset resolved for a dependency Either a named override or a dot separated string (A.B.C.D.*). e.g. for Rates curve 'EUR.*' will replace the resolve MarketAsset 'GBP/12M', 'GBP/3M' with the EUR equivalent, if there are no wildcards in the mask, the mask is taken as the MarketAsset for any dependency matching the rule.

Allows for partial or complete override of the market asset resolved for a dependency Either a named override or a dot separated string (A.B.C.D.*). e.g. for Rates curve 'EUR.*' will replace the resolve MarketAsset 'GBP/12M', 'GBP/3M' with the EUR equivalent, if there are no wildcards in the mask, the mask is taken as the MarketAsset for any dependency matching the rule.

◆ PriceSource

| string Lusid.Sdk.Model.MarketDataKeyRule.PriceSource |

|

getset |

The source of the quote. For a given provider/supplier of market data there may be an additional qualifier, e.g. the exchange or bank that provided the quote

The source of the quote. For a given provider/supplier of market data there may be an additional qualifier, e.g. the exchange or bank that provided the quote

◆ QuoteInterval

| string Lusid.Sdk.Model.MarketDataKeyRule.QuoteInterval |

|

getset |

Shorthand for the time interval used to select market data. This must be a dot-separated string nominating a start and end date, for example '5D.0D' to look back 5 days from today (0 days ago). The syntax is <i>int</i><i>char</i>.<i>int</i><i>char</i>, where <i>char</i> is one of D(ay), Bd(business day), W(eek), M(onth) or Y(ear). Business days are calculated using the calendars specified on the Valuation Request. If no calendar is provided in the request, then it will default to only skipping weekends. For example, if the valuation date is a Monday, then a quote interval of "1Bd" would behave as "3D", looking back to the Friday. Data with effectiveAt on the weekend will still be found in that window.

Shorthand for the time interval used to select market data. This must be a dot-separated string nominating a start and end date, for example '5D.0D' to look back 5 days from today (0 days ago). The syntax is <i>int</i><i>char</i>.<i>int</i><i>char</i>, where <i>char</i> is one of D(ay), Bd(business day), W(eek), M(onth) or Y(ear). Business days are calculated using the calendars specified on the Valuation Request. If no calendar is provided in the request, then it will default to only skipping weekends. For example, if the valuation date is a Monday, then a quote interval of "1Bd" would behave as "3D", looking back to the Friday. Data with effectiveAt on the weekend will still be found in that window.

◆ QuoteType

The available values are: Price, Spread, Rate, LogNormalVol, NormalVol, ParSpread, IsdaSpread, Upfront, Index, Ratio, Delta, PoolFactor, InflationAssumption, DirtyPrice

The available values are: Price, Spread, Rate, LogNormalVol, NormalVol, ParSpread, IsdaSpread, Upfront, Index, Ratio, Delta, PoolFactor, InflationAssumption, DirtyPrice

◆ SourceSystem

| string Lusid.Sdk.Model.MarketDataKeyRule.SourceSystem |

|

getset |

If set, this parameter will seek an external source of market data. Optional and, if omitted, will default to "Lusid". This means that data will be retrieved from the LUSID Quote Store and LUSID Complex Market Data Store. This can be set to "MarketDataOverrides" if Supplier is set to "Client".

If set, this parameter will seek an external source of market data. Optional and, if omitted, will default to "Lusid". This means that data will be retrieved from the LUSID Quote Store and LUSID Complex Market Data Store. This can be set to "MarketDataOverrides" if Supplier is set to "Client".

◆ Supplier

| string Lusid.Sdk.Model.MarketDataKeyRule.Supplier |

|

getset |

The market data supplier (where the data comes from)

The market data supplier (where the data comes from)

The documentation for this class was generated from the following file:

- /home/docs/checkouts/readthedocs.org/user_builds/lusid-sdk-csharp/checkouts/latest/sdk/Lusid.Sdk/Model/MarketDataKeyRule.cs