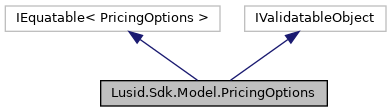

Options for controlling the default aspects and behaviour of the pricing engine.

More...

|

| | PricingOptions (ModelSelection modelSelection=default(ModelSelection), bool useInstrumentTypeToDeterminePricer=default(bool), bool allowAnyInstrumentsWithSecUidToPriceOffLookup=default(bool), bool allowPartiallySuccessfulEvaluation=default(bool), bool produceSeparateResultForLinearOtcLegs=default(bool), bool enableUseOfCachedUnitResults=default(bool), bool windowValuationOnInstrumentStartEnd=default(bool), bool removeContingentCashflowsInPaymentDiary=default(bool), bool useChildSubHoldingKeysForPortfolioExpansion=default(bool), bool validateDomesticAndQuoteCurrenciesAreConsistent=default(bool), string conservedQuantityForLookthroughExpansion=default(string)) |

| | Initializes a new instance of the PricingOptions class. More...

|

| |

| override string | ToString () |

| | Returns the string presentation of the object More...

|

| |

| virtual string | ToJson () |

| | Returns the JSON string presentation of the object More...

|

| |

| override bool | Equals (object input) |

| | Returns true if objects are equal More...

|

| |

| bool | Equals (PricingOptions input) |

| | Returns true if PricingOptions instances are equal More...

|

| |

| override int | GetHashCode () |

| | Gets the hash code More...

|

| |

|

| ModelSelection | ModelSelection [get, set] |

| | Gets or Sets ModelSelection More...

|

| |

| bool | UseInstrumentTypeToDeterminePricer [get, set] |

| | If true then use the instrument type to set the default instrument pricer This applies where no more specific set of overrides are provided on a per-vendor and instrument basis. More...

|

| |

| bool | AllowAnyInstrumentsWithSecUidToPriceOffLookup [get, set] |

| | By default, one would not expect to price and exotic instrument, i.e. an instrument with a complicated instrument definition simply through looking up a price as there should be a better way of evaluating it. To override that behaviour and allow lookup for a price from the instrument identifier(s), set this to true. More...

|

| |

| bool | AllowPartiallySuccessfulEvaluation [get, set] |

| | If true then a failure in task evaluation doesn't cause overall failure. results will be returned where they succeeded and annotation elsewhere More...

|

| |

| bool | ProduceSeparateResultForLinearOtcLegs [get, set] |

| | If true (default), when pricing an Fx-Forward or Interest Rate Swap, Future and other linearly separable products, product two results, one for each leg rather than a single line result with the amalgamated/summed pv from both legs. More...

|

| |

| bool | EnableUseOfCachedUnitResults [get, set] |

| | If true, when pricing using a model or for an instrument that supports use of intermediate cached-results, use them. Default is that this caching is turned off. More...

|

| |

| bool | WindowValuationOnInstrumentStartEnd [get, set] |

| | If true, when valuing an instrument outside the period where it is 'alive' (the start-maturity window) it will return a valuation of zero More...

|

| |

| bool | RemoveContingentCashflowsInPaymentDiary [get, set] |

| | When creating a payment diary, should contingent cash payments (e.g. from exercise of a swaption into a swap) be included or not. i.e. Is exercise or default being assumed to happen or not. More...

|

| |

| bool | UseChildSubHoldingKeysForPortfolioExpansion [get, set] |

| | Should fund constituents inherit subholding keys from the parent subholding keyb More...

|

| |

| bool | ValidateDomesticAndQuoteCurrenciesAreConsistent [get, set] |

| | Do we validate that the instrument domestic currency matches the quote currency (unless unknown/zzz) when using lookup pricing. More...

|

| |

| string | ConservedQuantityForLookthroughExpansion [get, set] |

| | When performing lookthrough portfolio expansion with ScalingMethodology set to "Sum" or "AbsoluteSum", the quantity specified here will be conserved and apportioned to lookthrough constituents. For example, an equal-weighting index with 100 constituents can be modelled as a reference portfolio with 1% weights on each equity. When expanding a $9000 holding of that index into its constituents while conserving PV, we end up with $90 of each equity. The number of units of each equity held is then implied. Note that conservation of one quantity may imply non-conservation of others, especially when some constituents are OTCs. Allowed values are: "PV" (default), "Exposure". More...

|

| |

Options for controlling the default aspects and behaviour of the pricing engine.

| bool Lusid.Sdk.Model.PricingOptions.AllowAnyInstrumentsWithSecUidToPriceOffLookup |

|

getset |

By default, one would not expect to price and exotic instrument, i.e. an instrument with a complicated instrument definition simply through looking up a price as there should be a better way of evaluating it. To override that behaviour and allow lookup for a price from the instrument identifier(s), set this to true.

By default, one would not expect to price and exotic instrument, i.e. an instrument with a complicated instrument definition simply through looking up a price as there should be a better way of evaluating it. To override that behaviour and allow lookup for a price from the instrument identifier(s), set this to true.

| string Lusid.Sdk.Model.PricingOptions.ConservedQuantityForLookthroughExpansion |

|

getset |

When performing lookthrough portfolio expansion with ScalingMethodology set to "Sum" or "AbsoluteSum", the quantity specified here will be conserved and apportioned to lookthrough constituents. For example, an equal-weighting index with 100 constituents can be modelled as a reference portfolio with 1% weights on each equity. When expanding a $9000 holding of that index into its constituents while conserving PV, we end up with $90 of each equity. The number of units of each equity held is then implied. Note that conservation of one quantity may imply non-conservation of others, especially when some constituents are OTCs. Allowed values are: "PV" (default), "Exposure".

When performing lookthrough portfolio expansion with ScalingMethodology set to "Sum" or "AbsoluteSum", the quantity specified here will be conserved and apportioned to lookthrough constituents. For example, an equal-weighting index with 100 constituents can be modelled as a reference portfolio with 1% weights on each equity. When expanding a $9000 holding of that index into its constituents while conserving PV, we end up with $90 of each equity. The number of units of each equity held is then implied. Note that conservation of one quantity may imply non-conservation of others, especially when some constituents are OTCs. Allowed values are: "PV" (default), "Exposure".

| bool Lusid.Sdk.Model.PricingOptions.EnableUseOfCachedUnitResults |

|

getset |

If true, when pricing using a model or for an instrument that supports use of intermediate cached-results, use them. Default is that this caching is turned off.

If true, when pricing using a model or for an instrument that supports use of intermediate cached-results, use them. Default is that this caching is turned off.

| bool Lusid.Sdk.Model.PricingOptions.ProduceSeparateResultForLinearOtcLegs |

|

getset |

If true (default), when pricing an Fx-Forward or Interest Rate Swap, Future and other linearly separable products, product two results, one for each leg rather than a single line result with the amalgamated/summed pv from both legs.

If true (default), when pricing an Fx-Forward or Interest Rate Swap, Future and other linearly separable products, product two results, one for each leg rather than a single line result with the amalgamated/summed pv from both legs.