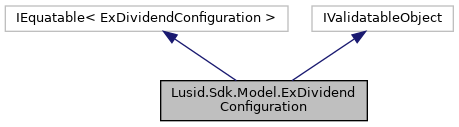

Configure the ex-dividend periods for the instrument.

More...

|

| bool | UseBusinessDays [get, set] |

| | Is the ex-dividend period counted in business days or calendar days. Defaults to true if not set. More...

|

| |

| int | ExDividendDays [get, set] |

| | Number of days in the ex-dividend period. If the settlement date falls in the ex-dividend period then the coupon paid is zero and the accrued interest is negative. If set, this must be a non-negative number. If not set, or set to 0, than there is no ex-dividend period. More...

|

| |

| bool | ReturnNegativeAccrued [get, set] |

| | Does the accrued interest go negative in the ex-dividend period, or does it go to zero. Defaults to true if not set. More...

|

| |

| bool | ApplyThirty360PayDelay [get, set] |

| | Set this flag to true if the ex-dividend days represent a pay delay from the accrual end date in calendar days under the 30/360 day count convention. The typical use case for this flag are Mortgage Backed Securities with pay delay between 1 and 60 days, such as FreddieMac and FannieMae. If this flag is set, the useBusinessDays setting will be ignored. Defaults to false if not provided. More...

|

| |

Configure the ex-dividend periods for the instrument.

◆ ExDividendConfiguration() [1/2]

| Lusid.Sdk.Model.ExDividendConfiguration.ExDividendConfiguration |

( |

| ) |

|

|

inlineprotected |

◆ ExDividendConfiguration() [2/2]

| Lusid.Sdk.Model.ExDividendConfiguration.ExDividendConfiguration |

( |

bool |

useBusinessDays = default(bool), |

|

|

int |

exDividendDays = default(int), |

|

|

bool |

returnNegativeAccrued = default(bool), |

|

|

bool |

applyThirty360PayDelay = default(bool) |

|

) |

| |

|

inline |

Initializes a new instance of the ExDividendConfiguration class.

- Parameters

-

| useBusinessDays | Is the ex-dividend period counted in business days or calendar days. Defaults to true if not set.. |

| exDividendDays | Number of days in the ex-dividend period. If the settlement date falls in the ex-dividend period then the coupon paid is zero and the accrued interest is negative. If set, this must be a non-negative number. If not set, or set to 0, than there is no ex-dividend period. (required). |

| returnNegativeAccrued | Does the accrued interest go negative in the ex-dividend period, or does it go to zero. Defaults to true if not set.. |

| applyThirty360PayDelay | Set this flag to true if the ex-dividend days represent a pay delay from the accrual end date in calendar days under the 30/360 day count convention. The typical use case for this flag are Mortgage Backed Securities with pay delay between 1 and 60 days, such as FreddieMac and FannieMae. If this flag is set, the useBusinessDays setting will be ignored. Defaults to false if not provided.. |

◆ Equals() [1/2]

◆ Equals() [2/2]

| override bool Lusid.Sdk.Model.ExDividendConfiguration.Equals |

( |

object |

input | ) |

|

|

inline |

Returns true if objects are equal

- Parameters

-

| input | Object to be compared |

- Returns

- Boolean

◆ GetHashCode()

| override int Lusid.Sdk.Model.ExDividendConfiguration.GetHashCode |

( |

| ) |

|

|

inline |

Gets the hash code

- Returns

- Hash code

◆ ToJson()

| virtual string Lusid.Sdk.Model.ExDividendConfiguration.ToJson |

( |

| ) |

|

|

inlinevirtual |

Returns the JSON string presentation of the object

- Returns

- JSON string presentation of the object

◆ ToString()

| override string Lusid.Sdk.Model.ExDividendConfiguration.ToString |

( |

| ) |

|

|

inline |

Returns the string presentation of the object

- Returns

- String presentation of the object

◆ ApplyThirty360PayDelay

| bool Lusid.Sdk.Model.ExDividendConfiguration.ApplyThirty360PayDelay |

|

getset |

Set this flag to true if the ex-dividend days represent a pay delay from the accrual end date in calendar days under the 30/360 day count convention. The typical use case for this flag are Mortgage Backed Securities with pay delay between 1 and 60 days, such as FreddieMac and FannieMae. If this flag is set, the useBusinessDays setting will be ignored. Defaults to false if not provided.

Set this flag to true if the ex-dividend days represent a pay delay from the accrual end date in calendar days under the 30/360 day count convention. The typical use case for this flag are Mortgage Backed Securities with pay delay between 1 and 60 days, such as FreddieMac and FannieMae. If this flag is set, the useBusinessDays setting will be ignored. Defaults to false if not provided.

◆ ExDividendDays

| int Lusid.Sdk.Model.ExDividendConfiguration.ExDividendDays |

|

getset |

Number of days in the ex-dividend period. If the settlement date falls in the ex-dividend period then the coupon paid is zero and the accrued interest is negative. If set, this must be a non-negative number. If not set, or set to 0, than there is no ex-dividend period.

Number of days in the ex-dividend period. If the settlement date falls in the ex-dividend period then the coupon paid is zero and the accrued interest is negative. If set, this must be a non-negative number. If not set, or set to 0, than there is no ex-dividend period.

◆ ReturnNegativeAccrued

| bool Lusid.Sdk.Model.ExDividendConfiguration.ReturnNegativeAccrued |

|

getset |

Does the accrued interest go negative in the ex-dividend period, or does it go to zero. Defaults to true if not set.

Does the accrued interest go negative in the ex-dividend period, or does it go to zero. Defaults to true if not set.

◆ UseBusinessDays

| bool Lusid.Sdk.Model.ExDividendConfiguration.UseBusinessDays |

|

getset |

Is the ex-dividend period counted in business days or calendar days. Defaults to true if not set.

Is the ex-dividend period counted in business days or calendar days. Defaults to true if not set.

The documentation for this class was generated from the following file:

- /home/docs/checkouts/readthedocs.org/user_builds/lusid-sdk-csharp/checkouts/latest/sdk/Lusid.Sdk/Model/ExDividendConfiguration.cs