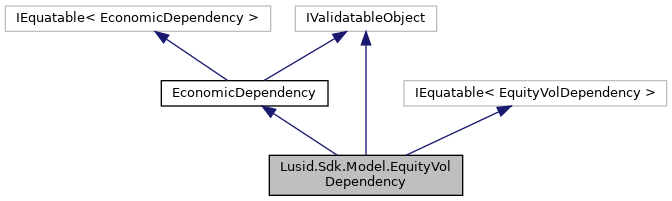

Economic dependency required to price Equity derivative products that contain optionality. Equity Vol surface is a grid of implied volatilities for an array of strikes and tenors, derived from vanilla option prices in the market. More...

Public Member Functions | |

| EquityVolDependency (string code=default(string), string domesticCurrency=default(string), string volType=default(string), DateTimeOffset date=default(DateTimeOffset), DependencyTypeEnum dependencyType=default(DependencyTypeEnum)) | |

| Initializes a new instance of the EquityVolDependency class. More... | |

| override string | ToString () |

| Returns the string presentation of the object More... | |

| override string | ToJson () |

| Returns the JSON string presentation of the object More... | |

| override bool | Equals (object input) |

| Returns true if objects are equal More... | |

| bool | Equals (EquityVolDependency input) |

| Returns true if EquityVolDependency instances are equal More... | |

| override int | GetHashCode () |

| Gets the hash code More... | |

Public Member Functions inherited from Lusid.Sdk.Model.EconomicDependency Public Member Functions inherited from Lusid.Sdk.Model.EconomicDependency | |

| EconomicDependency (DependencyTypeEnum dependencyType=default(DependencyTypeEnum)) | |

| Initializes a new instance of the EconomicDependency class. More... | |

| override string | ToString () |

| Returns the string presentation of the object More... | |

| override bool | Equals (object input) |

| Returns true if objects are equal More... | |

| bool | Equals (EconomicDependency input) |

| Returns true if EconomicDependency instances are equal More... | |

| override int | GetHashCode () |

| Gets the hash code More... | |

Protected Member Functions | |

| EquityVolDependency () | |

| Initializes a new instance of the EquityVolDependency class. More... | |

| IEnumerable< System.ComponentModel.DataAnnotations.ValidationResult > | BaseValidate (ValidationContext validationContext) |

| To validate all properties of the instance More... | |

Protected Member Functions inherited from Lusid.Sdk.Model.EconomicDependency Protected Member Functions inherited from Lusid.Sdk.Model.EconomicDependency | |

| EconomicDependency () | |

| Initializes a new instance of the EconomicDependency class. More... | |

| IEnumerable< System.ComponentModel.DataAnnotations.ValidationResult > | BaseValidate (ValidationContext validationContext) |

| To validate all properties of the instance More... | |

Properties | |

| string | Code [get, set] |

| The code identifying the corresponding equity, e.g. US0378331005 if the MarketIdentifier was set to ISIN More... | |

| string | DomesticCurrency [get, set] |

| The domestic currency of the instrument declaring this dependency. More... | |

| string | VolType [get, set] |

| Volatility type e.g. "LN" and "N" for log-normal and normal volatility. More... | |

| DateTimeOffset | Date [get, set] |

| The effectiveDate of the entity that this is a dependency for. Unless there is an obvious date this should be, like for a historic reset, then this is the valuation date. More... | |

Properties inherited from Lusid.Sdk.Model.EconomicDependency Properties inherited from Lusid.Sdk.Model.EconomicDependency | |

| DependencyTypeEnum | DependencyType [get, set] |

| The available values are: OpaqueDependency, CashDependency, DiscountingDependency, EquityCurveDependency, EquityVolDependency, FxDependency, FxForwardsDependency, FxVolDependency, IndexProjectionDependency, IrVolDependency, QuoteDependency, Vendor, CalendarDependency, InflationFixingDependency More... | |

Additional Inherited Members | |

Public Types inherited from Lusid.Sdk.Model.EconomicDependency Public Types inherited from Lusid.Sdk.Model.EconomicDependency | |

| enum class | DependencyTypeEnum { OpaqueDependency = 1 , CashDependency = 2 , DiscountingDependency = 3 , EquityCurveDependency = 4 , EquityVolDependency = 5 , FxDependency = 6 , FxForwardsDependency = 7 , FxVolDependency = 8 , IndexProjectionDependency = 9 , IrVolDependency = 10 , QuoteDependency = 11 , Vendor = 12 , CalendarDependency = 13 , InflationFixingDependency = 14 } |

| The available values are: OpaqueDependency, CashDependency, DiscountingDependency, EquityCurveDependency, EquityVolDependency, FxDependency, FxForwardsDependency, FxVolDependency, IndexProjectionDependency, IrVolDependency, QuoteDependency, Vendor, CalendarDependency, InflationFixingDependency More... | |

Detailed Description

Economic dependency required to price Equity derivative products that contain optionality. Equity Vol surface is a grid of implied volatilities for an array of strikes and tenors, derived from vanilla option prices in the market.

Constructor & Destructor Documentation

◆ EquityVolDependency() [1/2]

|

inlineprotected |

Initializes a new instance of the EquityVolDependency class.

◆ EquityVolDependency() [2/2]

|

inline |

Initializes a new instance of the EquityVolDependency class.

- Parameters

-

code The code identifying the corresponding equity, e.g. US0378331005 if the MarketIdentifier was set to ISIN (required). domesticCurrency The domestic currency of the instrument declaring this dependency. (required). volType Volatility type e.g. "LN" and "N" for log-normal and normal volatility. (required). date The effectiveDate of the entity that this is a dependency for. Unless there is an obvious date this should be, like for a historic reset, then this is the valuation date. (required). dependencyType The available values are: OpaqueDependency, CashDependency, DiscountingDependency, EquityCurveDependency, EquityVolDependency, FxDependency, FxForwardsDependency, FxVolDependency, IndexProjectionDependency, IrVolDependency, QuoteDependency, Vendor, CalendarDependency, InflationFixingDependency (required) (default to "EquityVolDependency").

Member Function Documentation

◆ BaseValidate()

|

inlineprotected |

To validate all properties of the instance

- Parameters

-

validationContext Validation context

- Returns

- Validation Result

◆ Equals() [1/2]

|

inline |

Returns true if EquityVolDependency instances are equal

- Parameters

-

input Instance of EquityVolDependency to be compared

- Returns

- Boolean

◆ Equals() [2/2]

|

inline |

Returns true if objects are equal

- Parameters

-

input Object to be compared

- Returns

- Boolean

◆ GetHashCode()

|

inline |

Gets the hash code

- Returns

- Hash code

◆ ToJson()

|

inlinevirtual |

Returns the JSON string presentation of the object

- Returns

- JSON string presentation of the object

Reimplemented from Lusid.Sdk.Model.EconomicDependency.

◆ ToString()

|

inline |

Returns the string presentation of the object

- Returns

- String presentation of the object

Property Documentation

◆ Code

|

getset |

The code identifying the corresponding equity, e.g. US0378331005 if the MarketIdentifier was set to ISIN

The code identifying the corresponding equity, e.g. US0378331005 if the MarketIdentifier was set to ISIN

◆ Date

|

getset |

The effectiveDate of the entity that this is a dependency for. Unless there is an obvious date this should be, like for a historic reset, then this is the valuation date.

The effectiveDate of the entity that this is a dependency for. Unless there is an obvious date this should be, like for a historic reset, then this is the valuation date.

◆ DomesticCurrency

|

getset |

The domestic currency of the instrument declaring this dependency.

The domestic currency of the instrument declaring this dependency.

◆ VolType

|

getset |

Volatility type e.g. "LN" and "N" for log-normal and normal volatility.

Volatility type e.g. "LN" and "N" for log-normal and normal volatility.

The documentation for this class was generated from the following file:

- /home/docs/checkouts/readthedocs.org/user_builds/lusid-sdk-csharp/checkouts/latest/sdk/Lusid.Sdk/Model/EquityVolDependency.cs