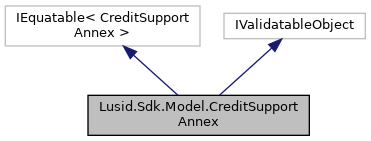

Entity to capture the calculable and queryable methods and practices of determining and transferring collateral to a counterparty as part of margining of transactions. These typically come from a particular ISDA agreement that is in place between the two counterparties.

More...

|

| | CreditSupportAnnex (string referenceCurrency=default(string), List< string > collateralCurrencies=default(List< string >), string isdaAgreementVersion=default(string), string marginCallFrequency=default(string), string valuationAgent=default(string), decimal thresholdAmount=default(decimal), int roundingDecimalPlaces=default(int), decimal initialMarginAmount=default(decimal), decimal minimumTransferAmount=default(decimal), ResourceId id=default(ResourceId)) |

| | Initializes a new instance of the CreditSupportAnnex class. More...

|

| |

| override string | ToString () |

| | Returns the string presentation of the object More...

|

| |

| virtual string | ToJson () |

| | Returns the JSON string presentation of the object More...

|

| |

| override bool | Equals (object input) |

| | Returns true if objects are equal More...

|

| |

| bool | Equals (CreditSupportAnnex input) |

| | Returns true if CreditSupportAnnex instances are equal More...

|

| |

| override int | GetHashCode () |

| | Gets the hash code More...

|

| |

|

| string | ReferenceCurrency [get, set] |

| | The base, or reference, currency against which MtM value and exposure should be calculated and in which the CSA parameters are defined if the currency is not otherwise explicitly stated. More...

|

| |

| List< string > | CollateralCurrencies [get, set] |

| | The set of currencies within which it is acceptable to post cash collateral. More...

|

| |

| string | IsdaAgreementVersion [get, set] |

| | The transactions will take place with reference to a particular ISDA master agreement. This will likely be either the ISDA 1992 or ISDA 2002 agremeents or ISDA close-out 2009. More...

|

| |

| string | MarginCallFrequency [get, set] |

| | The tenor, e.g. daily (1D) or biweekly (2W), at which frequency a margin call will be made, calculations made and money transferred to readjust. The calculation might also require a specific time for valuation and notification. More...

|

| |

| string | ValuationAgent [get, set] |

| | Are the calculations performed by the institutions's counterparty or the institution trading with them. More...

|

| |

| decimal | ThresholdAmount [get, set] |

| | At what level of exposure does collateral need to be posted. Will typically be zero for banks. Should be stated in reference currency More...

|

| |

| int | RoundingDecimalPlaces [get, set] |

| | Where a calculation needs to be rounded to a specific number of decimal places, this states the number that that requires. More...

|

| |

| decimal | InitialMarginAmount [get, set] |

| | The initial margin that is required. In the reference currency More...

|

| |

| decimal | MinimumTransferAmount [get, set] |

| | The minimum amount, in the reference currency, that must be transferred when required. More...

|

| |

| ResourceId | Id [get, set] |

| | Gets or Sets Id More...

|

| |

Entity to capture the calculable and queryable methods and practices of determining and transferring collateral to a counterparty as part of margining of transactions. These typically come from a particular ISDA agreement that is in place between the two counterparties.

◆ CreditSupportAnnex() [1/2]

| Lusid.Sdk.Model.CreditSupportAnnex.CreditSupportAnnex |

( |

| ) |

|

|

inlineprotected |

◆ CreditSupportAnnex() [2/2]

| Lusid.Sdk.Model.CreditSupportAnnex.CreditSupportAnnex |

( |

string |

referenceCurrency = default(string), |

|

|

List< string > |

collateralCurrencies = default(List<string>), |

|

|

string |

isdaAgreementVersion = default(string), |

|

|

string |

marginCallFrequency = default(string), |

|

|

string |

valuationAgent = default(string), |

|

|

decimal |

thresholdAmount = default(decimal), |

|

|

int |

roundingDecimalPlaces = default(int), |

|

|

decimal |

initialMarginAmount = default(decimal), |

|

|

decimal |

minimumTransferAmount = default(decimal), |

|

|

ResourceId |

id = default(ResourceId) |

|

) |

| |

|

inline |

Initializes a new instance of the CreditSupportAnnex class.

- Parameters

-

| referenceCurrency | The base, or reference, currency against which MtM value and exposure should be calculated and in which the CSA parameters are defined if the currency is not otherwise explicitly stated. (required). |

| collateralCurrencies | The set of currencies within which it is acceptable to post cash collateral. (required). |

| isdaAgreementVersion | The transactions will take place with reference to a particular ISDA master agreement. This will likely be either the ISDA 1992 or ISDA 2002 agremeents or ISDA close-out 2009. (required). |

| marginCallFrequency | The tenor, e.g. daily (1D) or biweekly (2W), at which frequency a margin call will be made, calculations made and money transferred to readjust. The calculation might also require a specific time for valuation and notification. (required). |

| valuationAgent | Are the calculations performed by the institutions's counterparty or the institution trading with them. (required). |

| thresholdAmount | At what level of exposure does collateral need to be posted. Will typically be zero for banks. Should be stated in reference currency (required). |

| roundingDecimalPlaces | Where a calculation needs to be rounded to a specific number of decimal places, this states the number that that requires. (required). |

| initialMarginAmount | The initial margin that is required. In the reference currency (required). |

| minimumTransferAmount | The minimum amount, in the reference currency, that must be transferred when required. (required). |

| id | id (required). |

◆ Equals() [1/2]

◆ Equals() [2/2]

| override bool Lusid.Sdk.Model.CreditSupportAnnex.Equals |

( |

object |

input | ) |

|

|

inline |

Returns true if objects are equal

- Parameters

-

| input | Object to be compared |

- Returns

- Boolean

◆ GetHashCode()

| override int Lusid.Sdk.Model.CreditSupportAnnex.GetHashCode |

( |

| ) |

|

|

inline |

Gets the hash code

- Returns

- Hash code

◆ ToJson()

| virtual string Lusid.Sdk.Model.CreditSupportAnnex.ToJson |

( |

| ) |

|

|

inlinevirtual |

Returns the JSON string presentation of the object

- Returns

- JSON string presentation of the object

◆ ToString()

| override string Lusid.Sdk.Model.CreditSupportAnnex.ToString |

( |

| ) |

|

|

inline |

Returns the string presentation of the object

- Returns

- String presentation of the object

◆ CollateralCurrencies

| List<string> Lusid.Sdk.Model.CreditSupportAnnex.CollateralCurrencies |

|

getset |

The set of currencies within which it is acceptable to post cash collateral.

The set of currencies within which it is acceptable to post cash collateral.

◆ Id

◆ InitialMarginAmount

| decimal Lusid.Sdk.Model.CreditSupportAnnex.InitialMarginAmount |

|

getset |

The initial margin that is required. In the reference currency

The initial margin that is required. In the reference currency

◆ IsdaAgreementVersion

| string Lusid.Sdk.Model.CreditSupportAnnex.IsdaAgreementVersion |

|

getset |

The transactions will take place with reference to a particular ISDA master agreement. This will likely be either the ISDA 1992 or ISDA 2002 agremeents or ISDA close-out 2009.

The transactions will take place with reference to a particular ISDA master agreement. This will likely be either the ISDA 1992 or ISDA 2002 agremeents or ISDA close-out 2009.

◆ MarginCallFrequency

| string Lusid.Sdk.Model.CreditSupportAnnex.MarginCallFrequency |

|

getset |

The tenor, e.g. daily (1D) or biweekly (2W), at which frequency a margin call will be made, calculations made and money transferred to readjust. The calculation might also require a specific time for valuation and notification.

The tenor, e.g. daily (1D) or biweekly (2W), at which frequency a margin call will be made, calculations made and money transferred to readjust. The calculation might also require a specific time for valuation and notification.

◆ MinimumTransferAmount

| decimal Lusid.Sdk.Model.CreditSupportAnnex.MinimumTransferAmount |

|

getset |

The minimum amount, in the reference currency, that must be transferred when required.

The minimum amount, in the reference currency, that must be transferred when required.

◆ ReferenceCurrency

| string Lusid.Sdk.Model.CreditSupportAnnex.ReferenceCurrency |

|

getset |

The base, or reference, currency against which MtM value and exposure should be calculated and in which the CSA parameters are defined if the currency is not otherwise explicitly stated.

The base, or reference, currency against which MtM value and exposure should be calculated and in which the CSA parameters are defined if the currency is not otherwise explicitly stated.

◆ RoundingDecimalPlaces

| int Lusid.Sdk.Model.CreditSupportAnnex.RoundingDecimalPlaces |

|

getset |

Where a calculation needs to be rounded to a specific number of decimal places, this states the number that that requires.

Where a calculation needs to be rounded to a specific number of decimal places, this states the number that that requires.

◆ ThresholdAmount

| decimal Lusid.Sdk.Model.CreditSupportAnnex.ThresholdAmount |

|

getset |

At what level of exposure does collateral need to be posted. Will typically be zero for banks. Should be stated in reference currency

At what level of exposure does collateral need to be posted. Will typically be zero for banks. Should be stated in reference currency

◆ ValuationAgent

| string Lusid.Sdk.Model.CreditSupportAnnex.ValuationAgent |

|

getset |

Are the calculations performed by the institutions's counterparty or the institution trading with them.

Are the calculations performed by the institutions's counterparty or the institution trading with them.

The documentation for this class was generated from the following file:

- /home/docs/checkouts/readthedocs.org/user_builds/lusid-sdk-csharp/checkouts/latest/sdk/Lusid.Sdk/Model/CreditSupportAnnex.cs