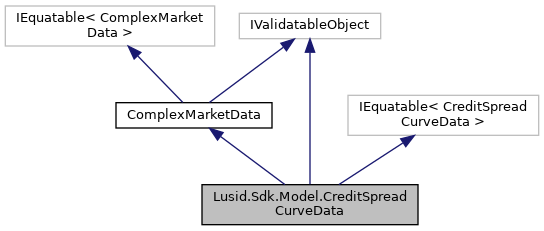

A credit spread curve matching tenors against par spread quotes More...

Public Member Functions | |

| CreditSpreadCurveData (DateTimeOffset baseDate=default(DateTimeOffset), string domCcy=default(string), List< string > tenors=default(List< string >), List< decimal > spreads=default(List< decimal >), decimal recoveryRate=default(decimal), DateTimeOffset? referenceDate=default(DateTimeOffset?), List< DateTimeOffset > maturities=default(List< DateTimeOffset >), string lineage=default(string), MarketDataOptions marketDataOptions=default(MarketDataOptions), MarketDataTypeEnum marketDataType=default(MarketDataTypeEnum)) | |

| Initializes a new instance of the CreditSpreadCurveData class. More... | |

| override string | ToString () |

| Returns the string presentation of the object More... | |

| override string | ToJson () |

| Returns the JSON string presentation of the object More... | |

| override bool | Equals (object input) |

| Returns true if objects are equal More... | |

| bool | Equals (CreditSpreadCurveData input) |

| Returns true if CreditSpreadCurveData instances are equal More... | |

| override int | GetHashCode () |

| Gets the hash code More... | |

Public Member Functions inherited from Lusid.Sdk.Model.ComplexMarketData Public Member Functions inherited from Lusid.Sdk.Model.ComplexMarketData | |

| ComplexMarketData (MarketDataTypeEnum marketDataType=default(MarketDataTypeEnum)) | |

| Initializes a new instance of the ComplexMarketData class. More... | |

| override string | ToString () |

| Returns the string presentation of the object More... | |

| override bool | Equals (object input) |

| Returns true if objects are equal More... | |

| bool | Equals (ComplexMarketData input) |

| Returns true if ComplexMarketData instances are equal More... | |

| override int | GetHashCode () |

| Gets the hash code More... | |

Protected Member Functions | |

| CreditSpreadCurveData () | |

| Initializes a new instance of the CreditSpreadCurveData class. More... | |

| IEnumerable< System.ComponentModel.DataAnnotations.ValidationResult > | BaseValidate (ValidationContext validationContext) |

| To validate all properties of the instance More... | |

Protected Member Functions inherited from Lusid.Sdk.Model.ComplexMarketData Protected Member Functions inherited from Lusid.Sdk.Model.ComplexMarketData | |

| ComplexMarketData () | |

| Initializes a new instance of the ComplexMarketData class. More... | |

| IEnumerable< System.ComponentModel.DataAnnotations.ValidationResult > | BaseValidate (ValidationContext validationContext) |

| To validate all properties of the instance More... | |

Properties | |

| DateTimeOffset | BaseDate [get, set] |

| EffectiveAt date of the quoted rates More... | |

| string | DomCcy [get, set] |

| Domestic currency of the curve More... | |

| List< string > | Tenors [get, set] |

| The tenors for which the rates apply For more information on tenors, see knowledge base article KA-02097 More... | |

| List< decimal > | Spreads [get, set] |

| Par spread quotes corresponding to the tenors. More... | |

| decimal | RecoveryRate [get, set] |

| The recovery rate in default. More... | |

| DateTimeOffset? | ReferenceDate [get, set] |

| If tenors are provided, this is the date against which the tenors will be resolved. This is of importance to CDX spread quotes, which are usually quoted in tenors relative to the CDX start date. In this case, the ReferenceDate would be equal to the CDX start date, and the BaseDate would be the date for which the spreads are valid. If not provided, this defaults to the BaseDate of the curve. More... | |

| List< DateTimeOffset > | Maturities [get, set] |

| The maturity dates for which the rates apply. Either tenors or maturities should be provided, not both. More... | |

| string | Lineage [get, set] |

| Description of the complex market data's lineage e.g. 'FundAccountant_GreenQuality'. More... | |

| MarketDataOptions | MarketDataOptions [get, set] |

| Gets or Sets MarketDataOptions More... | |

Properties inherited from Lusid.Sdk.Model.ComplexMarketData Properties inherited from Lusid.Sdk.Model.ComplexMarketData | |

| MarketDataTypeEnum | MarketDataType [get, set] |

| The available values are: DiscountFactorCurveData, EquityVolSurfaceData, FxVolSurfaceData, IrVolCubeData, OpaqueMarketData, YieldCurveData, FxForwardCurveData, FxForwardPipsCurveData, FxForwardTenorCurveData, FxForwardTenorPipsCurveData, FxForwardCurveByQuoteReference, CreditSpreadCurveData, EquityCurveByPricesData, ConstantVolatilitySurface More... | |

Additional Inherited Members | |

Public Types inherited from Lusid.Sdk.Model.ComplexMarketData Public Types inherited from Lusid.Sdk.Model.ComplexMarketData | |

| enum class | MarketDataTypeEnum { DiscountFactorCurveData = 1 , EquityVolSurfaceData = 2 , FxVolSurfaceData = 3 , IrVolCubeData = 4 , OpaqueMarketData = 5 , YieldCurveData = 6 , FxForwardCurveData = 7 , FxForwardPipsCurveData = 8 , FxForwardTenorCurveData = 9 , FxForwardTenorPipsCurveData = 10 , FxForwardCurveByQuoteReference = 11 , CreditSpreadCurveData = 12 , EquityCurveByPricesData = 13 , ConstantVolatilitySurface = 14 } |

| The available values are: DiscountFactorCurveData, EquityVolSurfaceData, FxVolSurfaceData, IrVolCubeData, OpaqueMarketData, YieldCurveData, FxForwardCurveData, FxForwardPipsCurveData, FxForwardTenorCurveData, FxForwardTenorPipsCurveData, FxForwardCurveByQuoteReference, CreditSpreadCurveData, EquityCurveByPricesData, ConstantVolatilitySurface More... | |

Detailed Description

A credit spread curve matching tenors against par spread quotes

Constructor & Destructor Documentation

◆ CreditSpreadCurveData() [1/2]

|

inlineprotected |

Initializes a new instance of the CreditSpreadCurveData class.

◆ CreditSpreadCurveData() [2/2]

|

inline |

Initializes a new instance of the CreditSpreadCurveData class.

- Parameters

-

baseDate EffectiveAt date of the quoted rates (required). domCcy Domestic currency of the curve (required). tenors The tenors for which the rates apply For more information on tenors, see knowledge base article KA-02097 (required). spreads Par spread quotes corresponding to the tenors. (required). recoveryRate The recovery rate in default. (required). referenceDate If tenors are provided, this is the date against which the tenors will be resolved. This is of importance to CDX spread quotes, which are usually quoted in tenors relative to the CDX start date. In this case, the ReferenceDate would be equal to the CDX start date, and the BaseDate would be the date for which the spreads are valid. If not provided, this defaults to the BaseDate of the curve.. maturities The maturity dates for which the rates apply. Either tenors or maturities should be provided, not both.. lineage Description of the complex market data's lineage e.g. 'FundAccountant_GreenQuality'.. marketDataOptions marketDataOptions. marketDataType The available values are: DiscountFactorCurveData, EquityVolSurfaceData, FxVolSurfaceData, IrVolCubeData, OpaqueMarketData, YieldCurveData, FxForwardCurveData, FxForwardPipsCurveData, FxForwardTenorCurveData, FxForwardTenorPipsCurveData, FxForwardCurveByQuoteReference, CreditSpreadCurveData, EquityCurveByPricesData, ConstantVolatilitySurface (required) (default to "CreditSpreadCurveData").

Member Function Documentation

◆ BaseValidate()

|

inlineprotected |

To validate all properties of the instance

- Parameters

-

validationContext Validation context

- Returns

- Validation Result

◆ Equals() [1/2]

|

inline |

Returns true if CreditSpreadCurveData instances are equal

- Parameters

-

input Instance of CreditSpreadCurveData to be compared

- Returns

- Boolean

◆ Equals() [2/2]

|

inline |

Returns true if objects are equal

- Parameters

-

input Object to be compared

- Returns

- Boolean

◆ GetHashCode()

|

inline |

Gets the hash code

- Returns

- Hash code

◆ ToJson()

|

inlinevirtual |

Returns the JSON string presentation of the object

- Returns

- JSON string presentation of the object

Reimplemented from Lusid.Sdk.Model.ComplexMarketData.

◆ ToString()

|

inline |

Returns the string presentation of the object

- Returns

- String presentation of the object

Property Documentation

◆ BaseDate

|

getset |

EffectiveAt date of the quoted rates

EffectiveAt date of the quoted rates

◆ DomCcy

|

getset |

Domestic currency of the curve

Domestic currency of the curve

◆ Lineage

|

getset |

Description of the complex market data's lineage e.g. 'FundAccountant_GreenQuality'.

Description of the complex market data's lineage e.g. 'FundAccountant_GreenQuality'.

◆ MarketDataOptions

|

getset |

Gets or Sets MarketDataOptions

◆ Maturities

|

getset |

The maturity dates for which the rates apply. Either tenors or maturities should be provided, not both.

The maturity dates for which the rates apply. Either tenors or maturities should be provided, not both.

◆ RecoveryRate

|

getset |

The recovery rate in default.

The recovery rate in default.

◆ ReferenceDate

|

getset |

If tenors are provided, this is the date against which the tenors will be resolved. This is of importance to CDX spread quotes, which are usually quoted in tenors relative to the CDX start date. In this case, the ReferenceDate would be equal to the CDX start date, and the BaseDate would be the date for which the spreads are valid. If not provided, this defaults to the BaseDate of the curve.

If tenors are provided, this is the date against which the tenors will be resolved. This is of importance to CDX spread quotes, which are usually quoted in tenors relative to the CDX start date. In this case, the ReferenceDate would be equal to the CDX start date, and the BaseDate would be the date for which the spreads are valid. If not provided, this defaults to the BaseDate of the curve.

◆ Spreads

|

getset |

Par spread quotes corresponding to the tenors.

Par spread quotes corresponding to the tenors.

◆ Tenors

|

getset |

The tenors for which the rates apply For more information on tenors, see knowledge base article KA-02097

The tenors for which the rates apply For more information on tenors, see knowledge base article KA-02097

The documentation for this class was generated from the following file:

- /home/docs/checkouts/readthedocs.org/user_builds/lusid-sdk-csharp/checkouts/latest/sdk/Lusid.Sdk/Model/CreditSpreadCurveData.cs