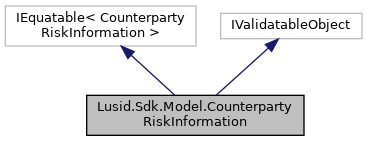

In the event that the legal entity is a counterparty to an OTC transaction (as signatory to a counterparty agreement such as an ISDA 2002 Master Agreement), this information would be needed for calculations such as Credit-Valuation-Adjustments and Debit-Valuation-Adjustments (CVA, DVA, XVA etc).

More...

In the event that the legal entity is a counterparty to an OTC transaction (as signatory to a counterparty agreement such as an ISDA 2002 Master Agreement), this information would be needed for calculations such as Credit-Valuation-Adjustments and Debit-Valuation-Adjustments (CVA, DVA, XVA etc).

◆ CounterpartyRiskInformation() [1/2]

| Lusid.Sdk.Model.CounterpartyRiskInformation.CounterpartyRiskInformation |

( |

| ) |

|

|

inlineprotected |

◆ CounterpartyRiskInformation() [2/2]

Initializes a new instance of the CounterpartyRiskInformation class.

- Parameters

-

| countryOfRisk | The country to which one would naturally ascribe risk, typically the legal entity's country of registration. This can be used to infer funding currency and related market data in the absence of a specific preference. (required). |

| creditRatings | creditRatings (required). |

| industryClassifiers | industryClassifiers (required). |

◆ Equals() [1/2]

◆ Equals() [2/2]

| override bool Lusid.Sdk.Model.CounterpartyRiskInformation.Equals |

( |

object |

input | ) |

|

|

inline |

Returns true if objects are equal

- Parameters

-

| input | Object to be compared |

- Returns

- Boolean

◆ GetHashCode()

| override int Lusid.Sdk.Model.CounterpartyRiskInformation.GetHashCode |

( |

| ) |

|

|

inline |

Gets the hash code

- Returns

- Hash code

◆ ToJson()

| virtual string Lusid.Sdk.Model.CounterpartyRiskInformation.ToJson |

( |

| ) |

|

|

inlinevirtual |

Returns the JSON string presentation of the object

- Returns

- JSON string presentation of the object

◆ ToString()

| override string Lusid.Sdk.Model.CounterpartyRiskInformation.ToString |

( |

| ) |

|

|

inline |

Returns the string presentation of the object

- Returns

- String presentation of the object

◆ CountryOfRisk

| string Lusid.Sdk.Model.CounterpartyRiskInformation.CountryOfRisk |

|

getset |

The country to which one would naturally ascribe risk, typically the legal entity's country of registration. This can be used to infer funding currency and related market data in the absence of a specific preference.

The country to which one would naturally ascribe risk, typically the legal entity's country of registration. This can be used to infer funding currency and related market data in the absence of a specific preference.

◆ CreditRatings

| List<CreditRating> Lusid.Sdk.Model.CounterpartyRiskInformation.CreditRatings |

|

getset |

Gets or Sets CreditRatings

◆ IndustryClassifiers

Gets or Sets IndustryClassifiers

The documentation for this class was generated from the following file:

- /home/docs/checkouts/readthedocs.org/user_builds/lusid-sdk-csharp/checkouts/latest/sdk/Lusid.Sdk/Model/CounterpartyRiskInformation.cs